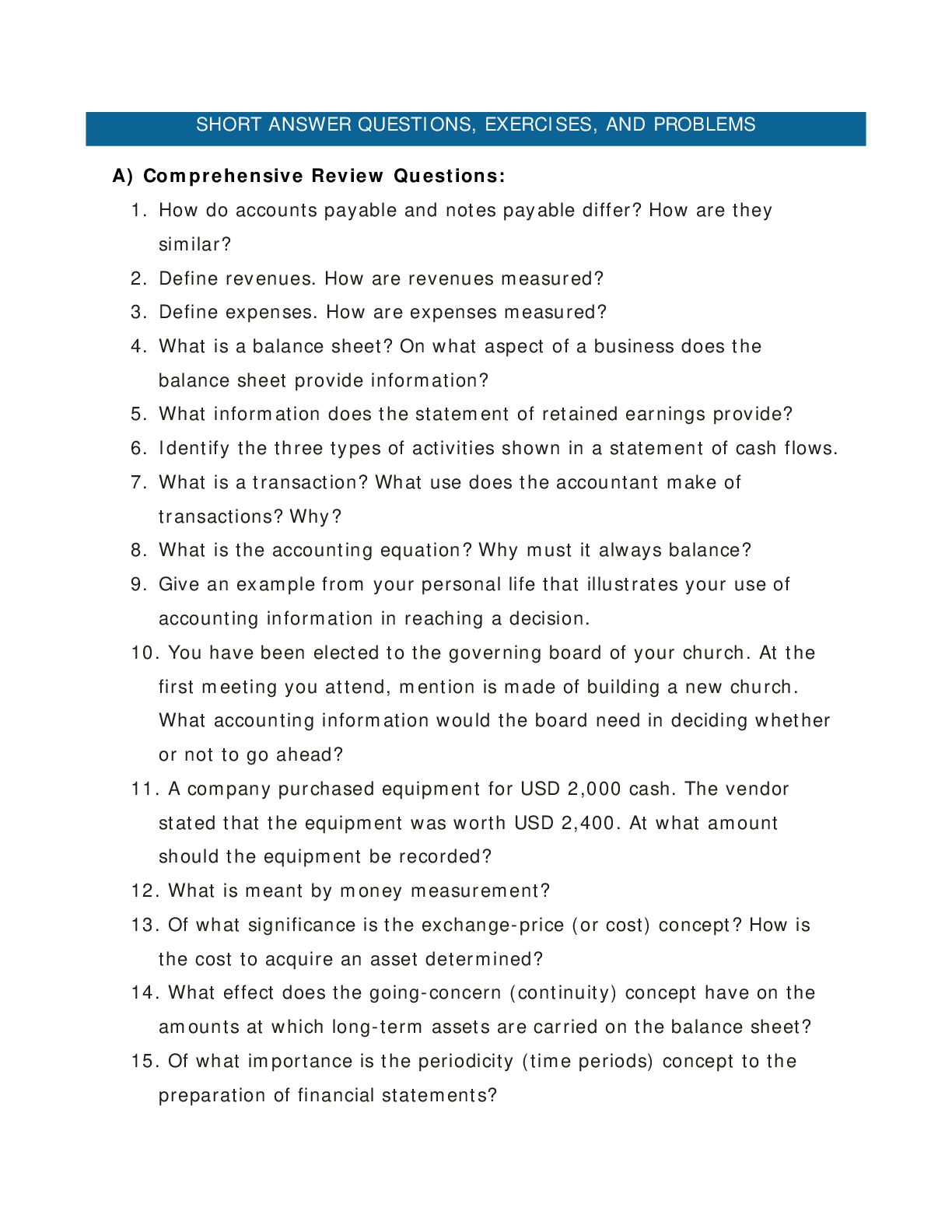

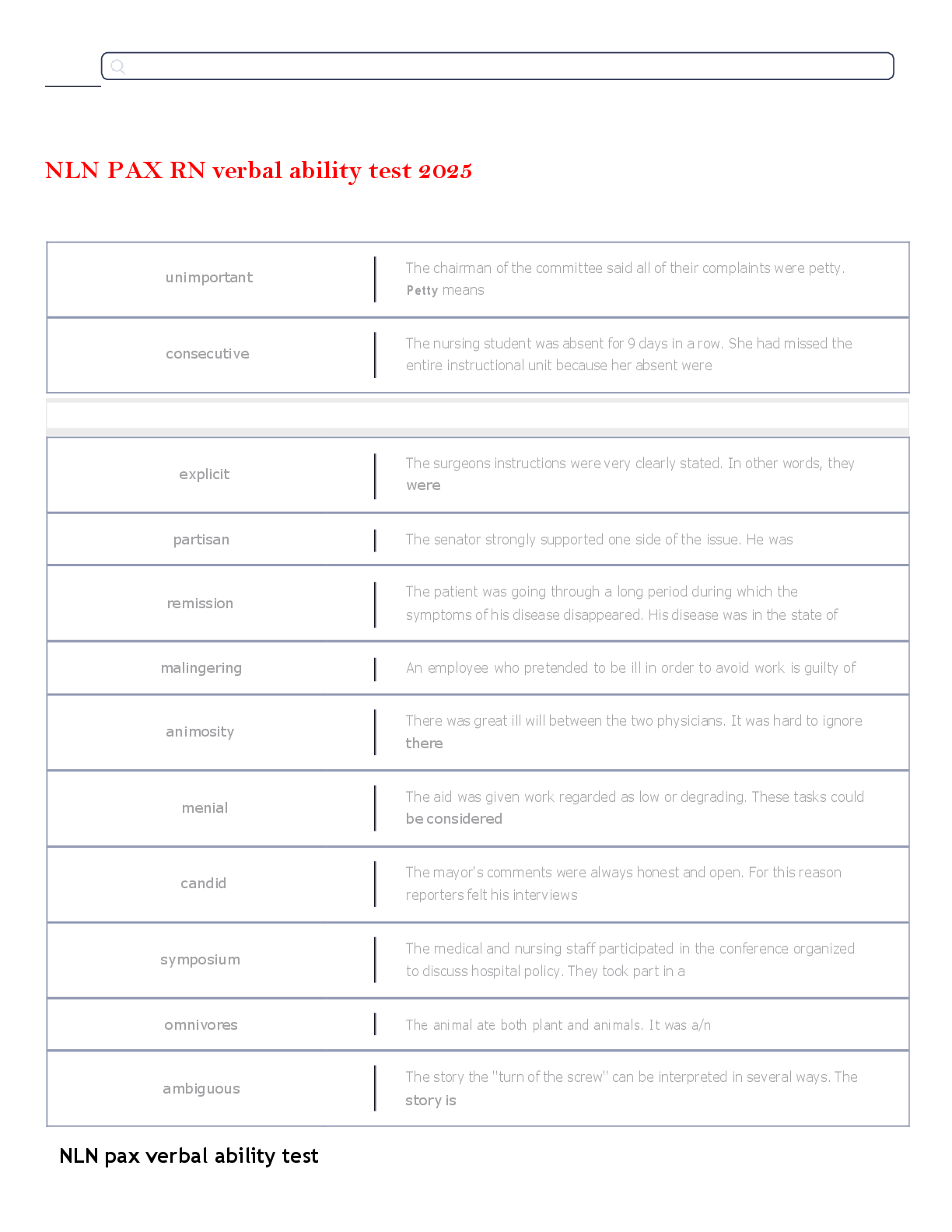

Comprehensive Review Questions:

1. How do accounts payable and notes payable differ? How are they

similar?

2. Define revenues. How are revenues measured?

3. Define expenses. How are expenses measured?

4. What is a b

...

Comprehensive Review Questions:

1. How do accounts payable and notes payable differ? How are they

similar?

2. Define revenues. How are revenues measured?

3. Define expenses. How are expenses measured?

4. What is a balance sheet? On what aspect of a business does the

balance sheet provide information?

5. What information does the statement of retained earnings provide?

6. Identify the three types of activities shown in a statement of cash flows.

7. What is a transaction? What use does the accountant make of

transactions? Why?

8. What is the accounting equation? Why must it always balance?

9. Give an example from your personal life that illustrates your use of

accounting information in reaching a decision.

10. You have been elected to the governing board of your church. At the

first meeting you attend, mention is made of building a new church.

What accounting information would the board need in deciding whether

or not to go ahead?

11. A company purchased equipment for USD 2,000 cash. The vendor

stated that the equipment was worth USD 2,400. At what amount

should the equipment be recorded?

12. What is meant by money measurement?

13. Of what significance is the exchange-price (or cost) concept? How is

the cost to acquire an asset determined?

14. What effect does the going-concern (continuity) concept have on the

amounts at which long-term assets are carried on the balance sheet?

15. Of what importance is the periodicity (time periods) concept to the

preparation of financial statements?

16. Describe a transaction that would:

a) Increase both an asset and capital stock.

b) Increase both an asset and a liability.

c) Increase one asset and decrease another asset.

d) Decrease both a liability and an asset.

e) Increase both an asset and retained earnings.

f) Decrease both an asset and retained earnings.

g) Increase a liability and decrease retained earnings.

h) Identify the causes of increases and decreases in

stockholders’ equity.

B) Accounting Exercises:

Exercise 1. Applying Basic Accounting Equation

Royals Palm, Inc. reports the following assets and liabilities. Compute the

totals that would appear in the corporation’s basic accounting equation

(Assets = Liabilities + Stockholders’ Equity (Capital Stock)).

Cash $65,000

Accounts Payable 28,000

Office Supplies 2,500

Loan Payable 7,000

Accounts Receivable 10,000

Answer:

Assets = Liabilities + Stockholders’ Equity

Exercise 2. Applying Basic Accounting Equation

Dan and Den, Inc. reports the following assets and liabilities. Compute the

totals that would appear in the corporation’s basic accounting equation

(Assets = Liabilities + Stockholders’ Equity (Capital Stock)).

Cash $37,000

Accounts Payable

[Show More]