Chapter 12 Segment Reporting and Decentralization

Multiple Choice Questions

16. If a cost is a common cost of the segments on a segmented income statement, the cost

should:

A) be allocated to the segments on the basi

...

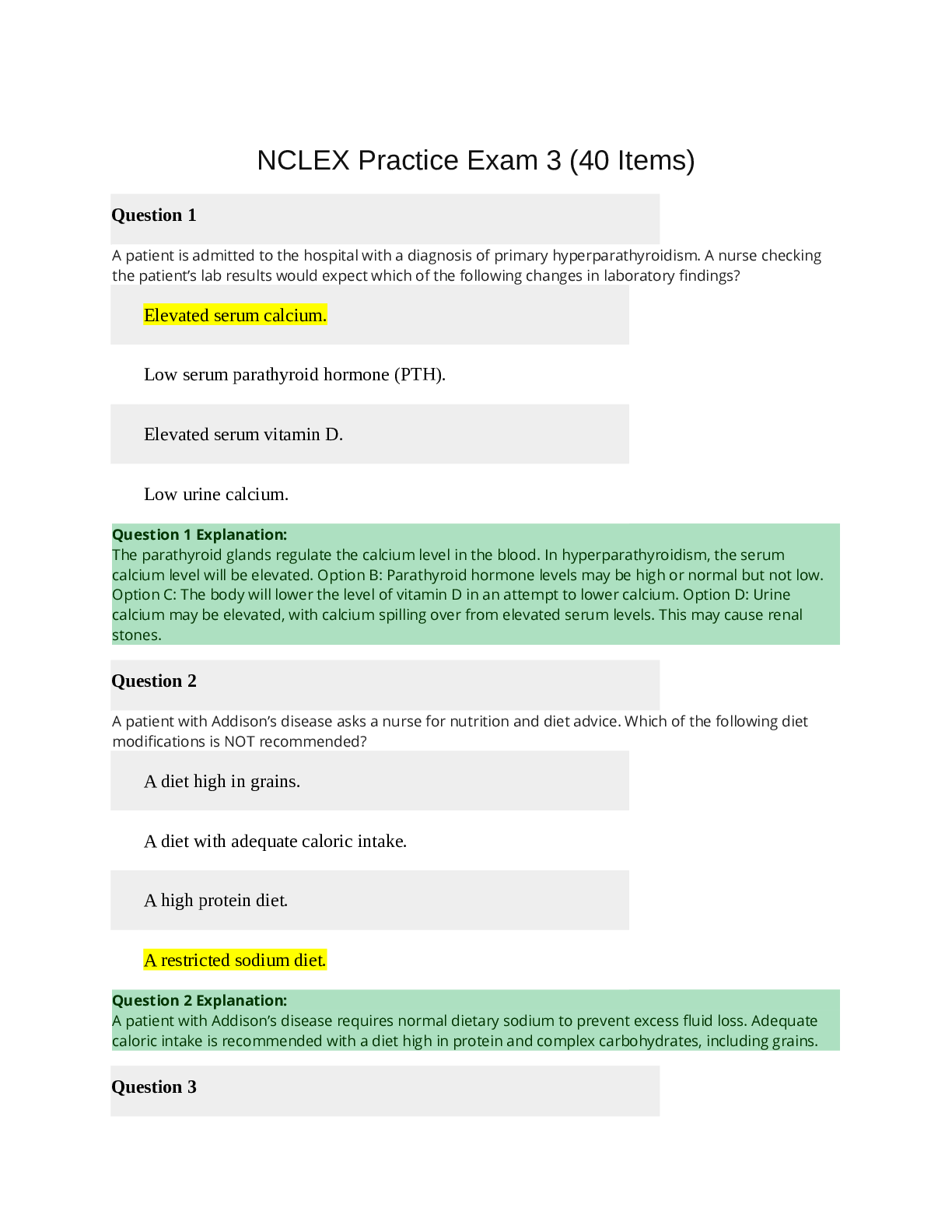

Chapter 12 Segment Reporting and Decentralization

Multiple Choice Questions

16. If a cost is a common cost of the segments on a segmented income statement, the cost

should:

A) be allocated to the segments on the basis of segment sales.

B) not be allocated to the segments.

C) excluded from the income statement.

D) treated as a product cost rather than as a period cost.

Answer: B Level: Medium LO: 1

17. Spiedino Company sells its products to both residential and commercial customers in

eight sales territories. In which of the following ways could Spiedino be segmented?

A) by product and then further segmented by type of customer.

B) by type of customer and then further segmented by sales territory.

C) by sales territory and then further segmented by product line.

D) all of the above.

Answer: D Level: Easy LO: 1

18. Which of the following is generally considered to be part of the value chain of a

manufacturing company?

A) marketing activities

B) customer service activities

C) research and development activities

D) both A and C above

E) all of the above

Answer: E Level: Easy LO: 1

19. A national retail company has segmented its income statement by sales territories. If

each sales territory statement is further segmented by individual stores, which of the

following will most likely occur?

A) some common fixed expenses in the sales territory segmented statement will

become traceable fixed expenses in the individual store segmented statement.

B) some traceable fixed expenses in the sales territory segmented statement will

become common fixed expenses in the individual store segmented statement.

C) the sum total of the individual stores' segment margins in each sales territory will

be equal to the segment margin for the sales territory.

D) both A and C above.

Answer: B Level: Medium LO: 1

Garrison, Managerial Accounting, 12th Edition 606

Chapter 12 Segment Reporting and Decentralization

20. Hayworth Company has just segmented last year's income statements into its ten

product lines. The chief executive officer (CEO) is curious as to what effect dropping

one of the product lines at the beginning of last year would have had on overall

company profit. What is the best number for the CEO to look at to determine the effect

of this elimination on the net operating income of the company as a whole?

A) the product line's sales dollars.

B) the product line's contribution margin.

C) the product line's segment margin.

D) the product line's segment margin minus an allocated portion of common fixed

expenses.

Answer: C Level: Easy LO: 1

21. In an income statement segmented by product line, a fixed expense that cannot be

allocated among product lines on a cause-and-effect basis should be:

A) classified as a variable expense.

B) allocated to the product lines on the basis of sales dollars.

C) allocated to the product lines on the basis of segment margin.

D) classified as a common fixed expense and not allocated.

E) classified as a traceable fixed expense and not allocated.

Answer: D Level: Medium LO: 1

22. Managerial performance can be measured in many different ways including return on

investment (ROI) and residual income. A good reason for using residual income

instead of ROI is:

A) Residual income can be computed without having to measure operating assets.

B) Managers are more likely to accept projects that are beneficial to the company.

C) ROI does not take into account both turnover and margin.

D) A minimum rate of return does not have to be specified when the residual income

approach is used.

Answer: B Level: Medium LO: 2,3 Source: CMA, adapted

[Show More]