Solutions Manual Physics (Volume 2) 12th Edition By John Cutnell, Kenneth Johnson, David Young, Shane Stadler

$ 30

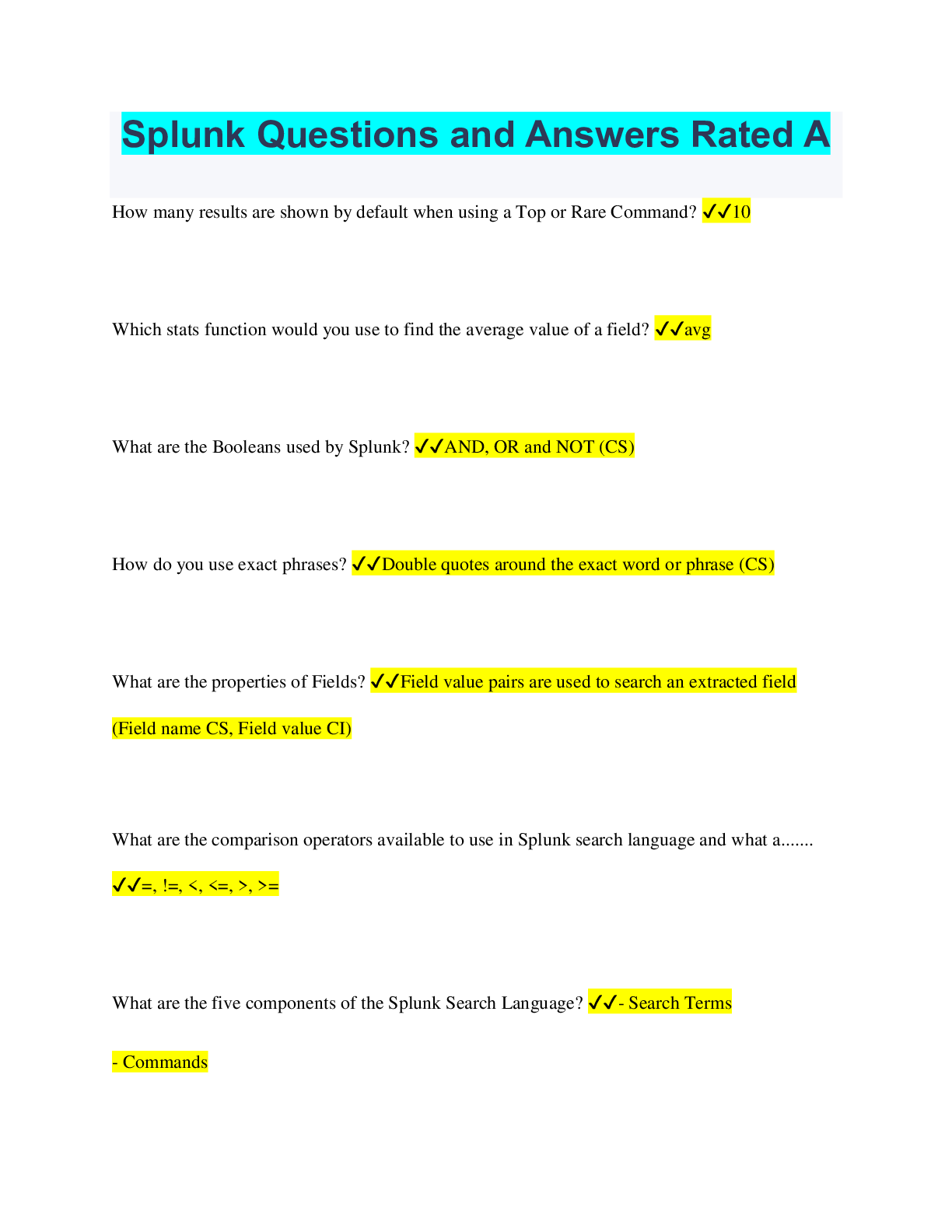

Splunk Questions and Answers Rated A

$ 7.5

NR 511 Week 7 CPG Presentation – Cholesterol – Hyperlipidemia:Chamberlain College Of Nursing

$ 12

Human Resource Management Functions, Applications, and Skill Development 4th Edition by Robert N. Lussier | LECTURE NOTES

$ 19

GCSE COMBINED SCIENCE: TRILOGY Higher Tier Physics Paper 1H

$ 6

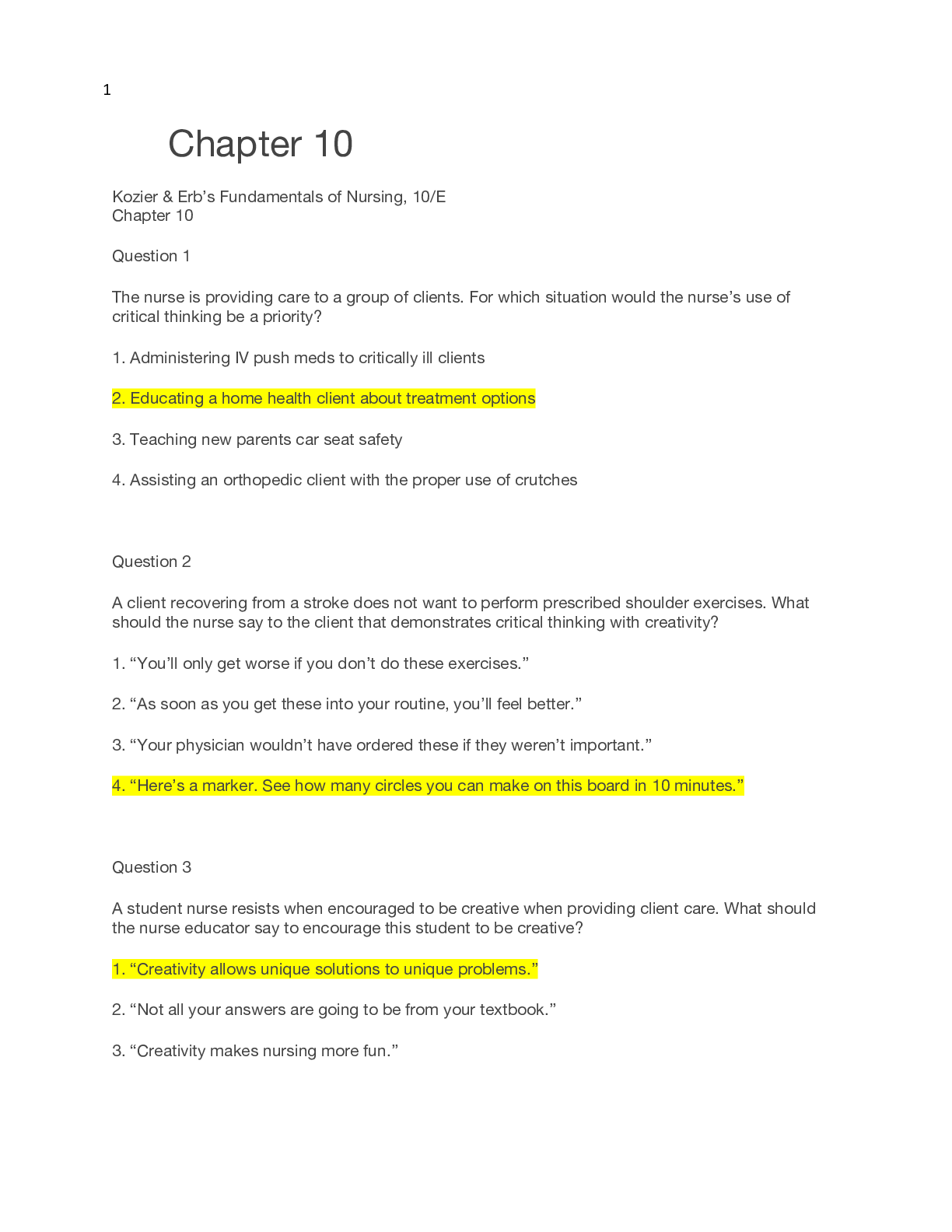

Chapter 10 Kozier & Erb’s Fundamentals of Nursing

$ 8.5

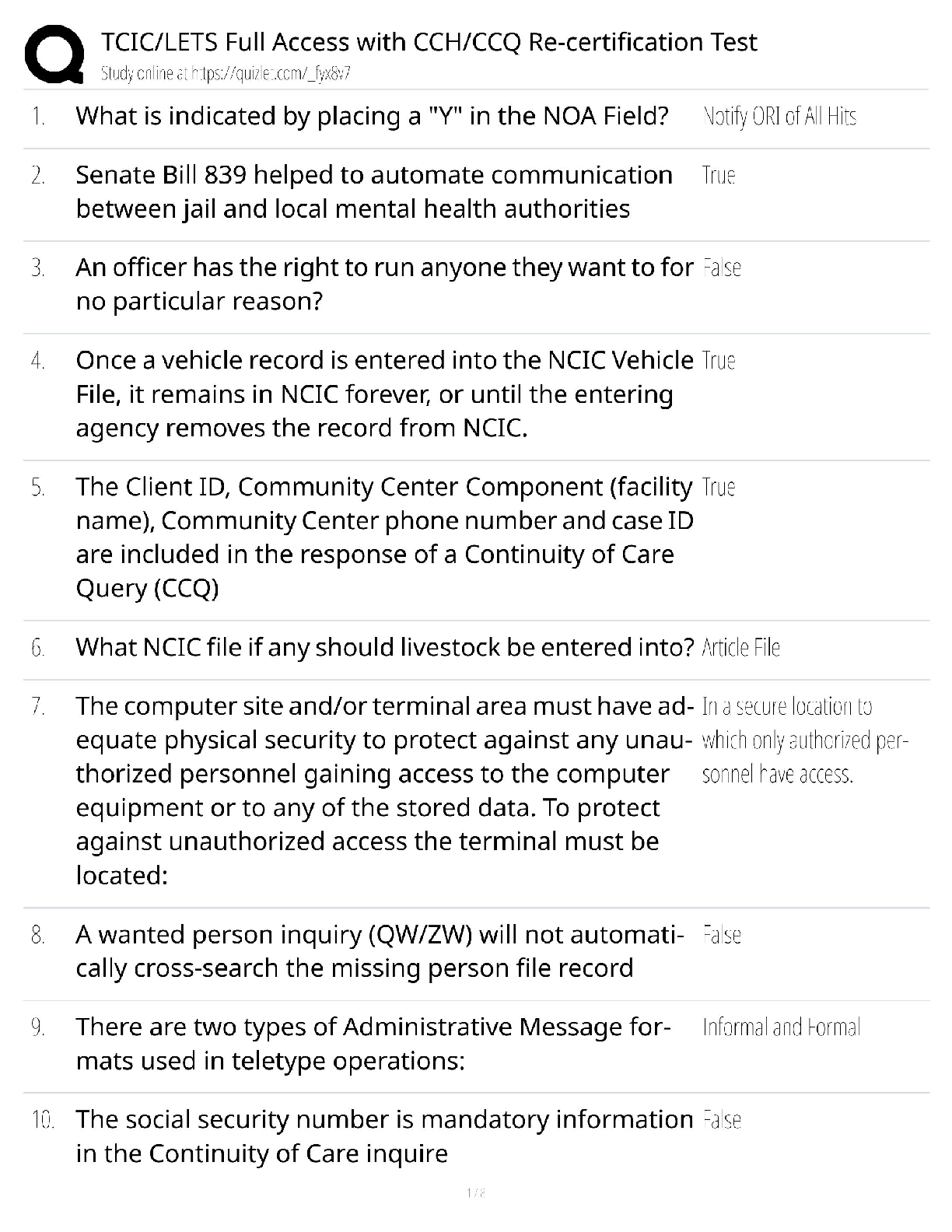

POST 400 TCIC LETS Full Access / CCH CCQ Re-certification Test / Law Enforcement Study Guide 2025 / Score 100%

$ 23

ALAT Certification – Study Questions with Verified Answers

$ 14.5

The US is constantly advancing its healthcare systems, improving the average life expectancy among the US population, but these changes in the healthcare system have led to a continual increase in US healthcare spending. In 2016, the US GDP spending on healthcare was 17.8%, which was the highest compared to other developed countries (Woskie, 2018). This high spending is not directly proportional to the performance in the healthcare sector. The difference in healthcare expenditure is due to slightly higher salaries for the healthcare personnel, administrative cost, and pharmaceutical cost. Efforts to shift the healthcare system to a more positive direction have led to identifying eight themes that may alter critical trends in the US healthcare market.

$ 10

eBook The Legal Environment of Business Text and Cases 11th Edition By Frank Cross, Roger Miller

$ 29

eBook Basic Legal Writing for Paralegals 6e Hope Viner Samborn, Andrea Yelin

$ 29

[eTextBook] [PDF] The Application of Heat in Oncology Principles and Practice By Devashish Shrivastava

$ 25

HSCI 345 STATISTICAL FOR HEALTH SCIENCES EXAM Q & A WITH RATIONALES 2024

$ 15

PDF(eBook) Urologic Robotic Surgery,Jeffrey A. Stock , Michael P. Esposito, Vincent Lante,1e

$ 25

Living Theatre A History of Theatre 7th Edition By Edwin Wilson, Alvin Goldfarb (Test Bank All Chapters)

$ 18

Comprehensive Lecture Notes ISYE 6501 Midterm 2.

$ 6

The GFK Reports Worldwide Survey