Economics > QUESTIONS & ANSWERS > ECON 4741mb11th.im.part3_EOC_Solutions_13.ALL ANSWERS CORRECT (All)

ECON 4741mb11th.im.part3_EOC_Solutions_13.ALL ANSWERS CORRECT

Document Content and Description Below

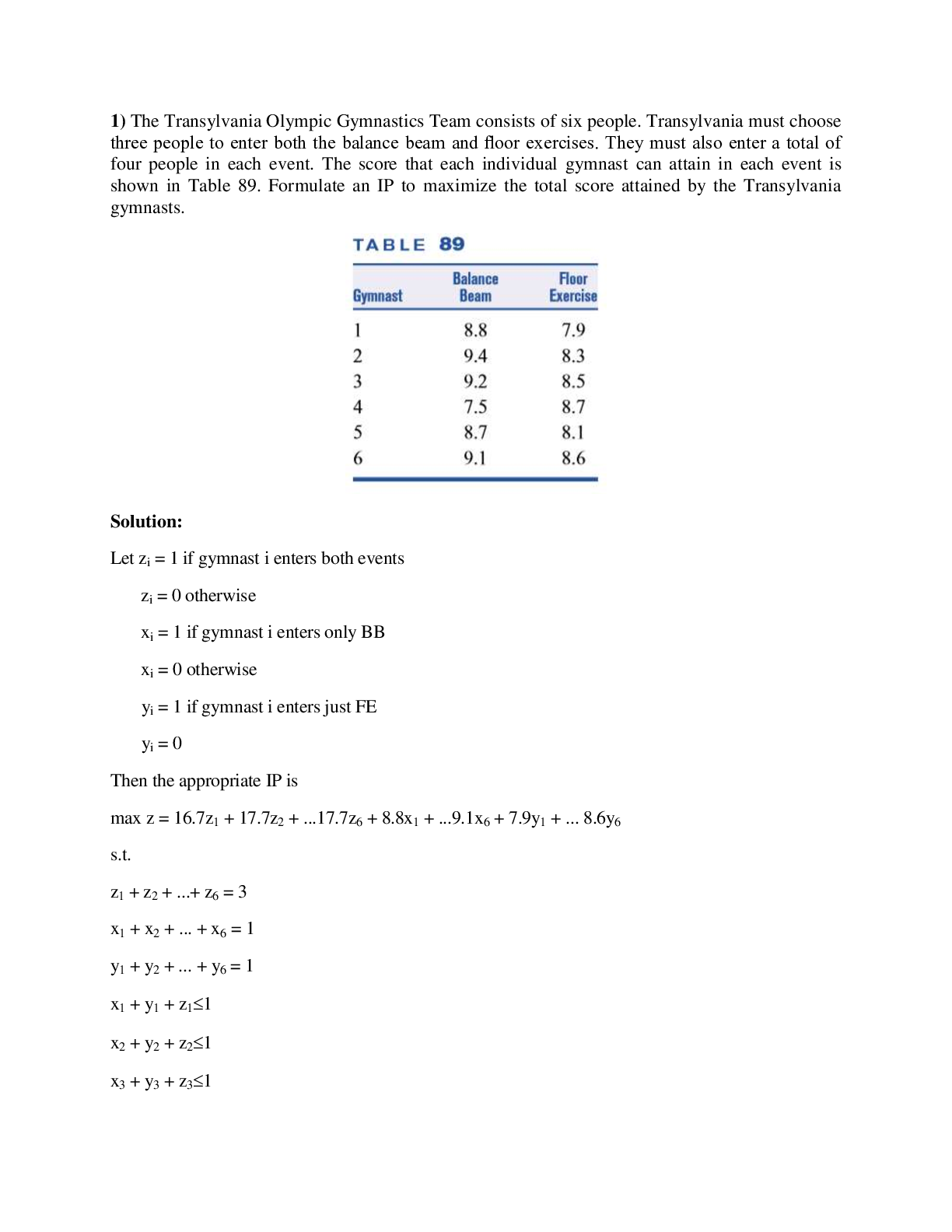

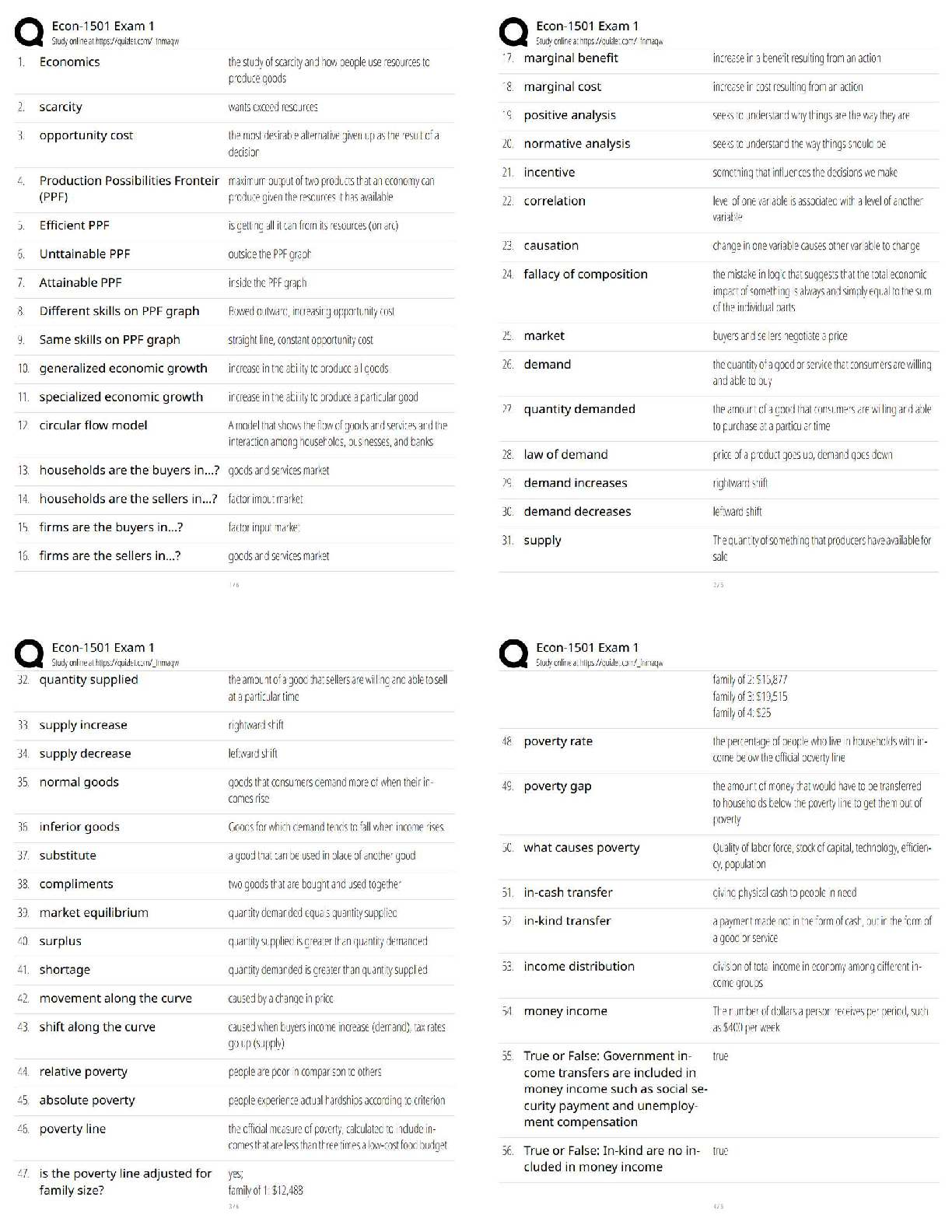

ANSWERS TO APPLIED PROBLEMS 20. Suppose you visit with a financial adviser, and you are considering investing some of your wealth in one of three investment portfolios: stocks, bonds, or commodities ... . Your financial adviser provides you with the following table, which gives the probabilities of possible returns from each investment: Stocks Bonds Commodities Probability Return Probability Return Probability Return 0.25 12% 0.6 10% 0.2 20% 0.25 10% 0.4 7.50% 0.25 12% 0.25 8% 0.25 6% 0.25 6% 0.25 4% 0.05 0% a. Which investment should you choose to maximize your expected return: stocks, bonds, or commodities? b. If you are risk-averse and have to choose between the stock and the bond investments, which should you choose? Why? 21. An important way in which the Federal Reserve decreases the money supply is by selling bonds to the public. Using a supply and demand analysis for bonds, show what effect this action has on interest rates. Is your answer consistent with what you would expect to find with the liquidity preference framework? This study source was downloaded by 100000784424693 from CourseHero.com on 06-17-2021 05:11:07 GMT -05:00 https://www.coursehero.com/file/11221960/mb11thimpart3-EOC-Solutions-13/ This study resource was shar [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 17, 2021

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 17, 2021

Downloads

0

Views

147