Computer Science > QUESTIONS & ANSWERS > XCEL Chapter 1 Exam Review Questions and Answers Already Passed (All)

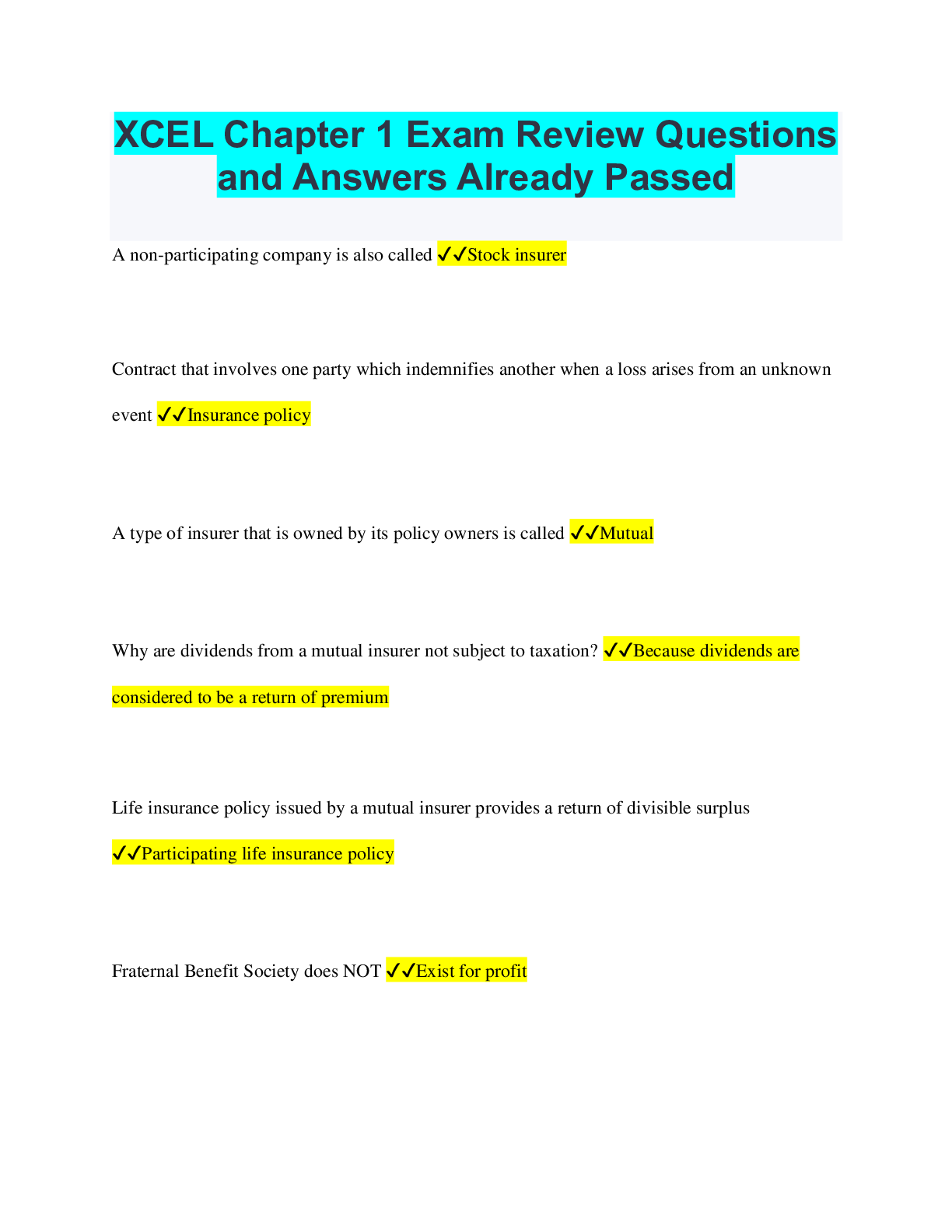

XCEL Chapter 1 Exam Review Questions and Answers Already Passed

Document Content and Description Below

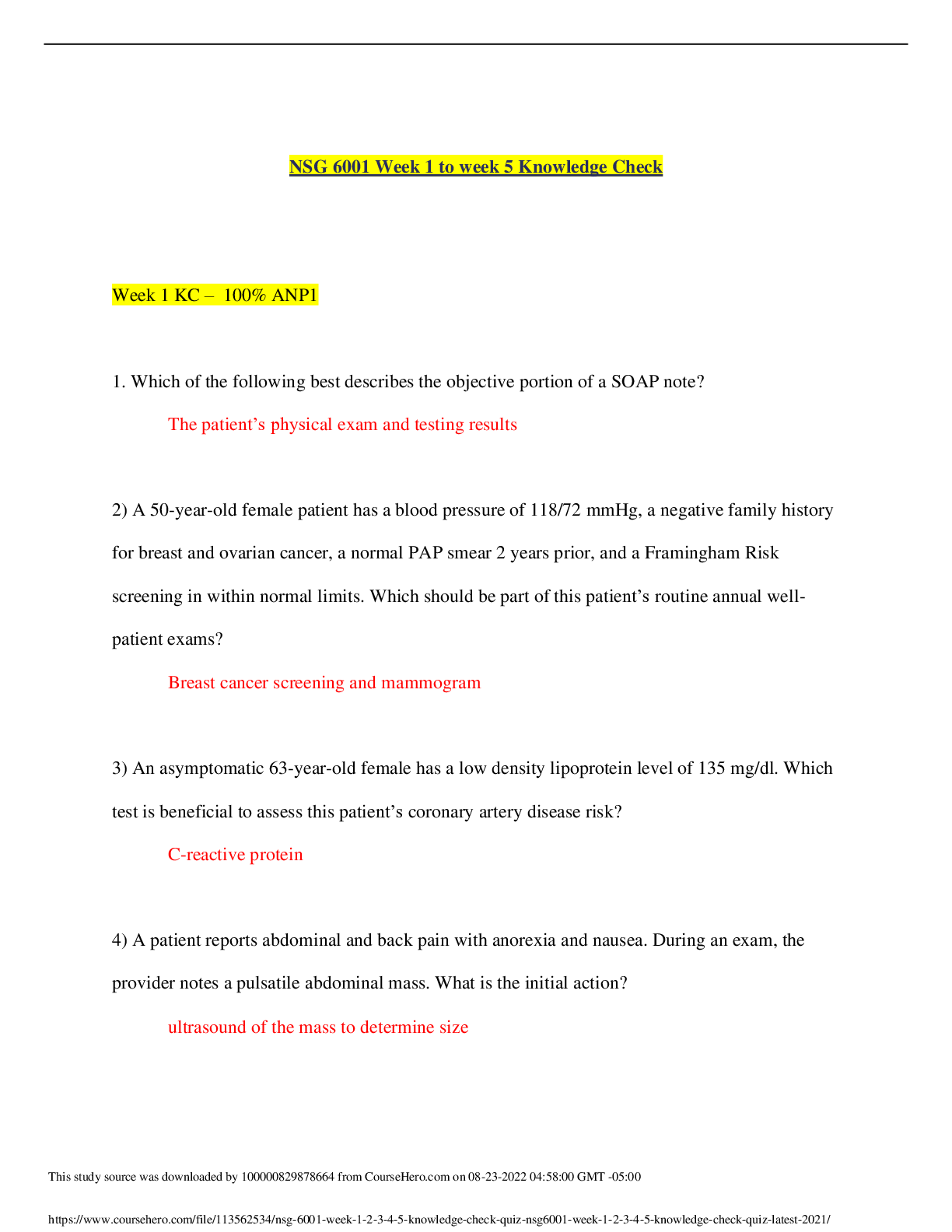

XCEL Chapter 1 Exam Review Questions and Answers Already Passed A non-participating company is also called ✔✔Stock insurer Contract that involves one party which indemnifies another when a loss ... arises from an unknown event ✔✔Insurance policy A type of insurer that is owned by its policy owners is called ✔✔Mutual Why are dividends from a mutual insurer not subject to taxation? ✔✔Because dividends are considered to be a return of premium Life insurance policy issued by a mutual insurer provides a return of divisible surplus ✔✔Participating life insurance policy Fraternal Benefit Society does NOT ✔✔Exist for profit Type of insurance where an insurer transfers loss exposures from policies written for its insurers ✔✔Reinsurance What is a true statement regarding a life insurance policy dividend? ✔✔It is the distribution of excess of funds accumulated by the insurer on participating policies Insurer owned by its policyholders ✔✔Mutual Insurer A life insurance company has transferred some of its risk to another insurer. The insurer assuming the risk is called the ✔✔Reinsurer One important function of an insurance company is to identify and sell to potential customers. Which of these BEST describes this function? ✔✔Marketing John owns an insurance policy that gives him the right to share in the insurer's surplus. What kind of policy is this? ✔✔Participating policy Does not participate in paying dividends ✔✔Non-participating policy Contract that allows the policy owner to receive a share of surplus in the form of policy dividends ✔✔Participating life insurance policy Minimum penalty under the McCarran-Ferguson Act ✔✔$10,000 or up to 1 year in jail When a mutual insurer becomes a stock company ✔✔Demutualization A plan in which an employer pays insurance benefits from a fund derived from the employer's current revenues ✔✔Self-funded plan Regulates insurer's claim settlement practices ✔✔State insurance departments Maximum penalty under the Fair Credit and Reporting Act ✔✔$5,000 and 1 year imprisonment AKA Re-insurer ✔✔Mutual Insurer An insurer enters into a contract with a third party to insure itself against losses from insurance policies it issues. What is this agreement called? ✔✔Reinsurance Primary reason for purchasing life insurance ✔✔Death benefits Insurer established by a parent company for the purpose of insuring the parent company's loss exposures ✔✔Captive Insurer Protects consumers with guidelines regarding credit reporting and distribution ✔✔The Fair Credit and Reporting Act [Show More]

Last updated: 2 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 26, 2023

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 26, 2023

Downloads

0

Views

82

.png)