Computer Science > QUESTIONS & ANSWERS > XCEL Final Exam Questions and Answers Already Graded A+ (All)

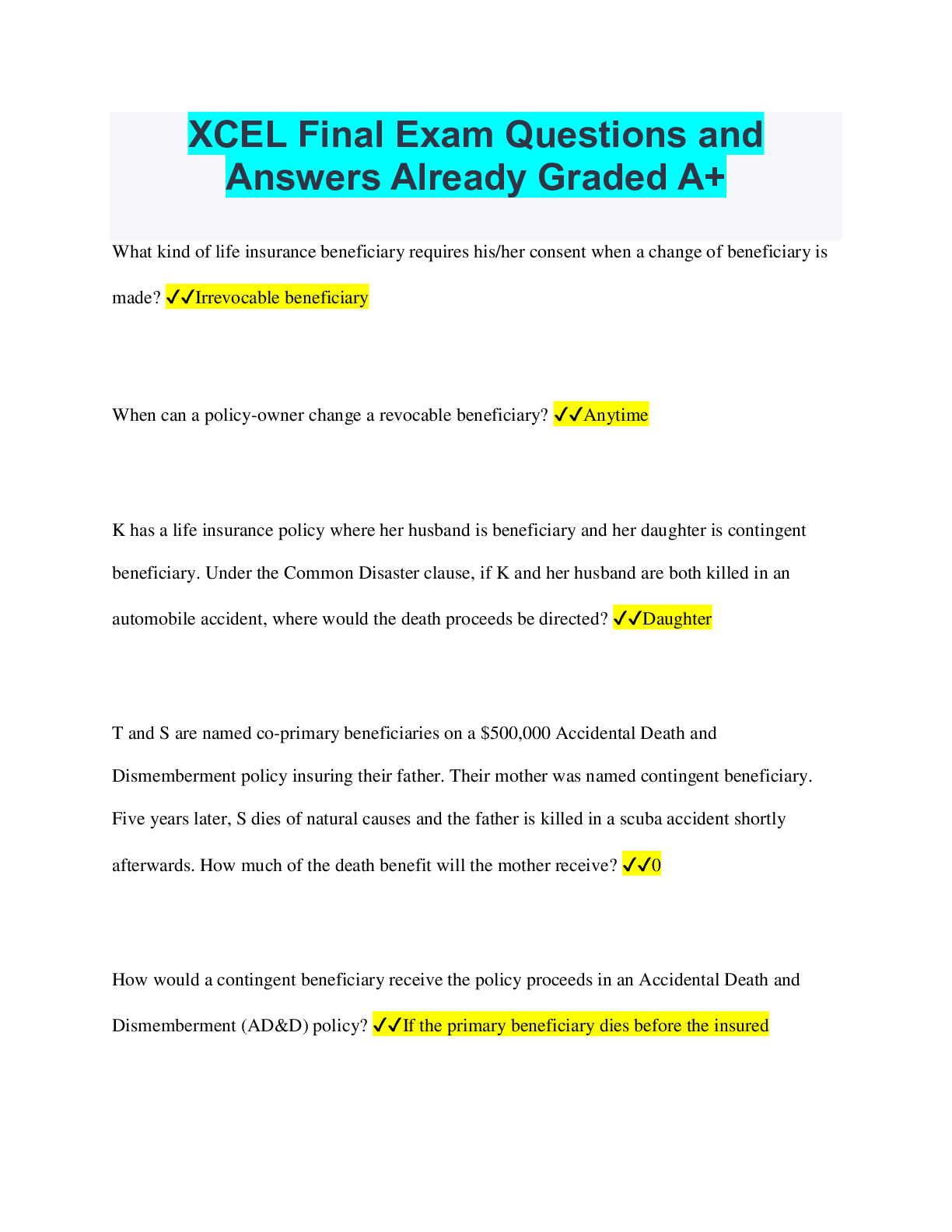

XCEL Final Exam Questions and Answers Already Graded A+

Document Content and Description Below

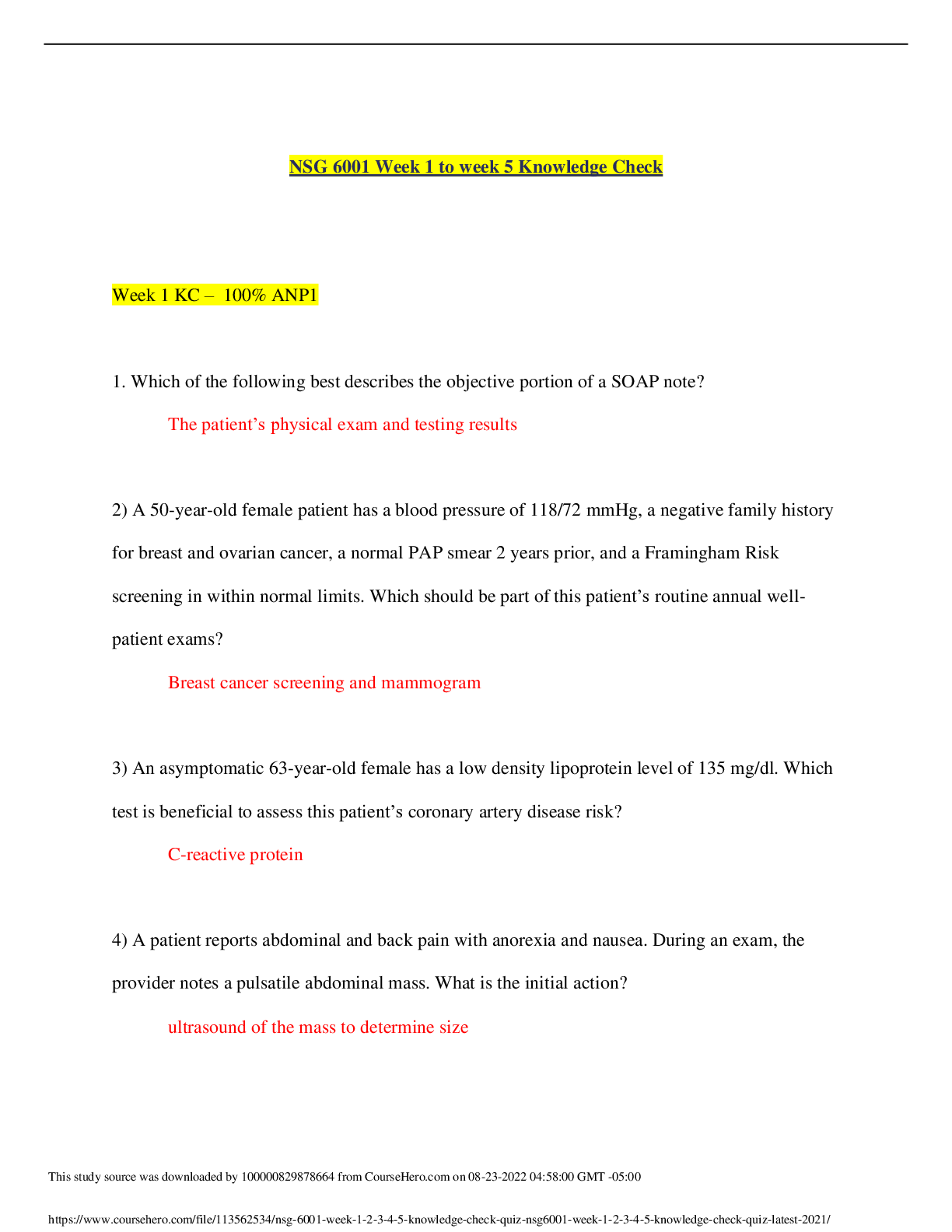

XCEL Final Exam Questions and Answers Already Graded A+ What kind of life insurance beneficiary requires his/her consent when a change of beneficiary is made? ✔✔Irrevocable beneficiary When ca ... n a policy-owner change a revocable beneficiary? ✔✔Anytime K has a life insurance policy where her husband is beneficiary and her daughter is contingent beneficiary. Under the Common Disaster clause, if K and her husband are both killed in an automobile accident, where would the death proceeds be directed? ✔✔Daughter T and S are named co-primary beneficiaries on a $500,000 Accidental Death and Dismemberment policy insuring their father. Their mother was named contingent beneficiary. Five years later, S dies of natural causes and the father is killed in a scuba accident shortly afterwards. How much of the death benefit will the mother receive? ✔✔0 How would a contingent beneficiary receive the policy proceeds in an Accidental Death and Dismemberment (AD&D) policy? ✔✔If the primary beneficiary dies before the insured A policy would like to change the beneficiary on a Life insurance policy and make the change permanent. Which type of designation would fulfill this need? ✔✔Irrevocable What is the underlying concept regarding level premiums? ✔✔The early years are charged more than what is needed A policy-owner is able to choose the frequency of premium payments through what policy feature? ✔✔Premium Mode A policy owner is allowed to pay premiums more than once a year under which provision? ✔✔Mode of Premium An incomplete life insurance application submitted to an insurer will result in which of these actions? ✔✔Application will be returned to the writing agent. Any changes made on an insurance application requires the initials of whom? ✔✔Applicant P is a producer who notices 5 questions on a life application were not answered. What actions should P take? ✔✔Set up a meeting with the applicant to answer the remaining questions Q applied for life insurance and submitted the initial premium on January 1. The policy was issued February 1, but it was not delivered by the agent until February 7. Q is dissatisfied and returns the policy February 13. How will the insurer handle this situation? ✔✔Policy was returned within the free-look period, premium will be fully refunded. Who is NOT required to sign a life insurance application? ✔✔Beneficiary What action should a producer take if the initial premium is NOT Submitted with the application? ✔✔Forward the application o the insurer without the initial premium. An applicant's medical information received from the Medical Information Bureau (MIB) may be furnished to the ✔✔applicant's physician What is the purpose of the USA Patriot Act ✔✔To detect and deter terrorism Which requirement must be met for an association to be eligible for a group life plan? ✔✔The group was formed for a purpose other than acquiring insurance [Show More]

Last updated: 2 years ago

Preview 1 out of 17 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 26, 2023

Number of pages

17

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 26, 2023

Downloads

0

Views

105

.png)