Mathematics > QUESTIONS & ANSWERS > MATH 3589 Calculous - Ohio State University. Introduction to Financial Mathematics Homework Assignme (All)

MATH 3589 Calculous - Ohio State University. Introduction to Financial Mathematics Homework Assignment #8 Solutions.

Document Content and Description Below

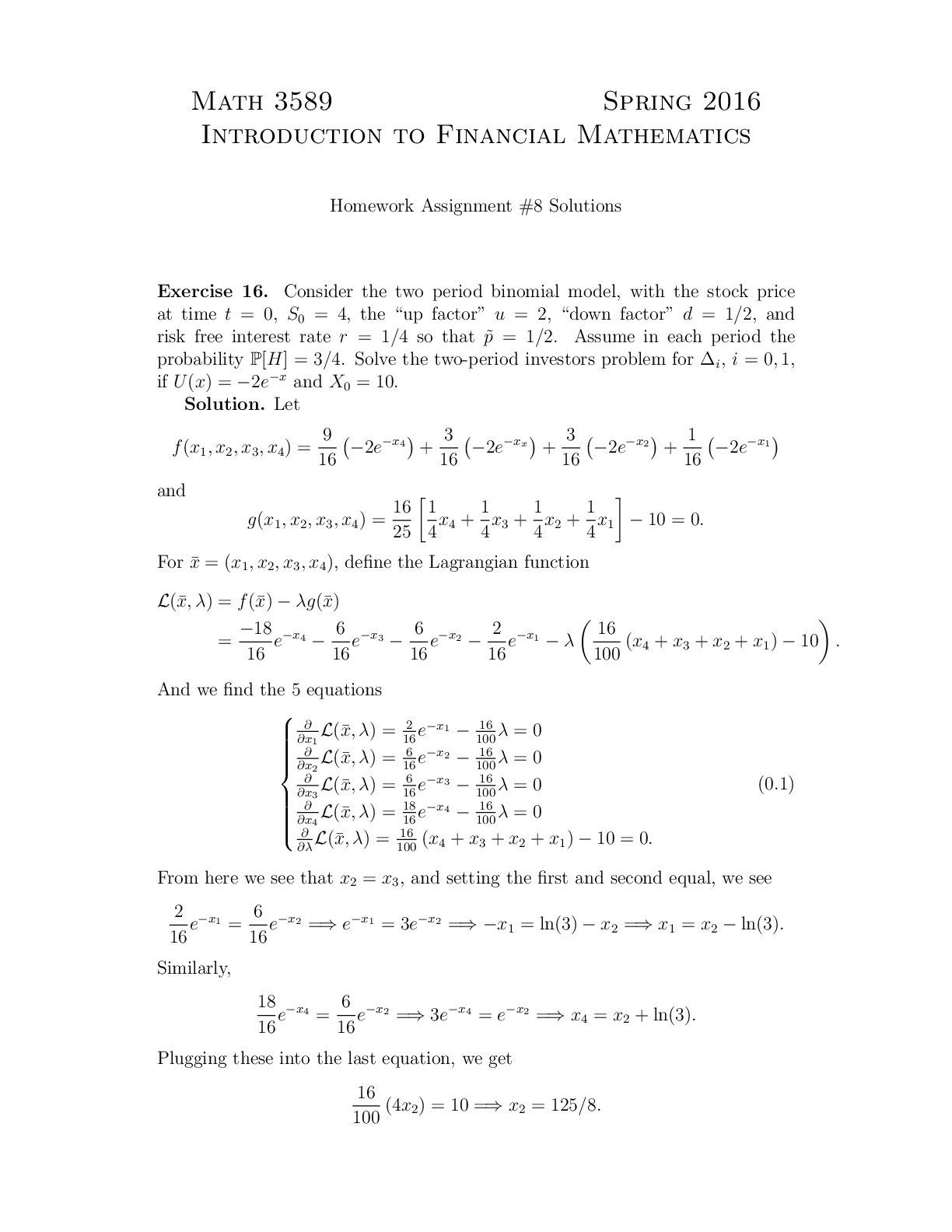

MATH 3589 Calculous - Ohio State University. Introduction to Financial Mathematics Homework Assignment #8 Solutions. Consider the two period binomial model, with the stock price at time t = 0, S0 = ... 4, the \up factor" u = 2, \down factor" d = 1=2, and risk free interest rate r = 1=4 so that ~ p = 1=2. Assume in each period the probability P[H] = 3=4. Solve the two-period investors problem for ∆i, i = 0; 1, if U(x) = −2e−x and X0 = 10. In the previous problem, what was the optimal percentage of wealth invested in the stock each period? Consider the N-period optimal investment problem with U(x) = ln(x). Let ζ(!) be the state price density and ζn, n = 0; 1; : : : ; N be the state price density process. a. Show that for each sequence of coin tosses ! = !m the optimal wealth will be XN(!m) = ζ(X!m0 ). b. Show that the optimal portfolio process is Xn = Xζn0 , n = 0; 1; : : : ; N. Assume P[H] = 3=4, S0 = 4, the \up factor" u = 2, the \down factor" d = 1=2 and the risk-free interest rate is r = 1=4. Solve the above investors problem (consumption and investment) for x1, x2 and C0 using the method of Lagrangian multipliers if U(x) = −x−1=2 and W0 = 10. How did a larger coefficient of relative risk aversion effect the amount consumed at time t = 0? Suppose the world consists of two stocks, with expected returns µ1 = 3=4 and µ2 = 5=4 respectively, as well as a risk free bond paying an interest rate of r = 1=4. The variances on the stocks are σ12 = 1 and σ22 = 4 respectively. Find your maximum expected return, µ, in this world if your target variance is σ2 = 2. What are the optimal percentages of your wealth invested in each stock, as well as the optimal percentage invested in the bond? We want to solve the constrained optimization problem [Show More]

Last updated: 2 years ago

Preview 1 out of 5 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 13, 2023

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 13, 2023

Downloads

0

Views

52