Health Care > QUESTIONS & ANSWERS > Ch2 VA state and health, Questions and answers. 2022/2023. Rated A (All)

Ch2 VA state and health, Questions and answers. 2022/2023. Rated A

Document Content and Description Below

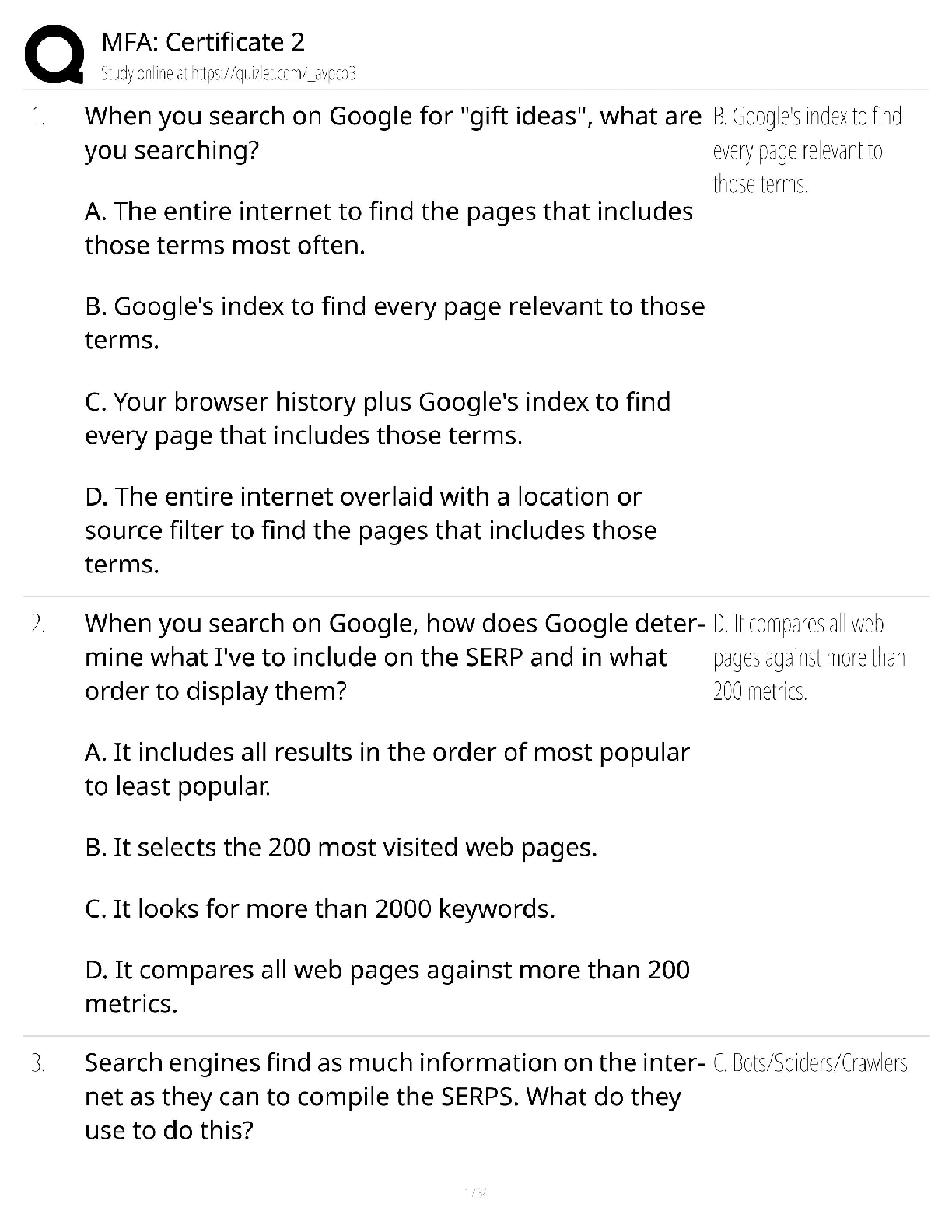

Ch2 VA state and health, Questions and answers. 2022/2023. Rated A Which of the following is true regarding the premium in term policies? A) Only level term policy has a level premium. B) In in ... creasing term policies the premium will increase as the death benefit increases. C) Decreasing term policy will have a decreasing premium. D) The premium in any type of term policy is usually level. - ✔✔D) The premium in any type of term policy is usually level In comparison with other primary types of term insurance sold, what kind of premium does level term have? A) Highest B) Most inconsistent C) Lowest D) Most level - ✔✔A) Highest Which of the following pairs would best describe the coverage and the premium (respectively) provided by term policies, as compared to any other form of protection? A) Longest-lasting; lowest B) Greatest; lowest C) Least; highest D) Most comprehensive; highest - ✔✔B) Greatest; lowest Which of the following would NOT be true regarding a $100,000 20 year level term policy? A) At the end of 20 years, the policys cash value will equal $100,000 B) The policy premiums will remain level for 20 years C) If the insured dies before the policy expired, the beneficiary will receive $100,000 D) The policy will expire at the end of the 20 year period - ✔✔A) At the end of 20 years, the policy's cash value will equal $100,000 Which of the following would be considered a disadvantage of term insurance? A) If the insured dies during the term, the policy pays only the accumulated cash value. B) If the insured dies after the end of the term, there is no death benefit to the beneficiary. C) The policy provides the smallest amount of coverage for the highest premium D) It cannot be renewed or converted to a permanent policy - ✔✔B) If the insured dies after the end of the term, there is no death benefit to the beneficiary Which of the following is true regarding a level term insurance policy? A) Death benefit is paid out to the beneficiary if the insured dies after the premium paying period ends. B) It provides temporary protection C) The premium remains level, but the death benefit could be increased or decreased. D) It charges the lowest premiums of all term insurance policies - ✔✔B) It provides temporary protection Which one of the following is not one of the three basic types of coverage's that are available, based on how the face amount changes during the policy term? A) Level B) Increasing C) Renewable D) Decreasing - ✔✔C) Renewable Which of the following best describes annually renewable term insurance? A) It provides annually increasing death benefit. B) It is a level term insurance C) It requires proof of insurability at each renewal. D) Neither the premium nor the death benefit is affected by the insured's age. - ✔✔B) It is a level term insurance What does "level" refer to in level term insurance? A) Premium B) Cash Value C) Interest rate D) Face amount - ✔✔D) Face amount A man decided to purchase a $100,000 Annually Renewable Term life policy to provide additional protection until his children finished college. He discovered that his policy A) Required proof of insurability every year. B) Decreased death benefit at each renewal. C) Required a premium increase each renewal. D) Built cash values. - ✔✔C) Required a premium increase each renewal. An individual has just borrowed $10,000 from his bank on a 5-year note. What type of life insurance policy would be best suited to this situation? A) Whole life B) Decreasing term C) Variable life D) Universal life - ✔✔B) Decreasing term The type of term insurance that provides increasing death benefits as the insured ages is called A) Age-sensitive term. B) Increasing term. C) Flexible term. D) Interest-sensitive term. - ✔✔B) Increasing term. Your client wants both protection and savings from the insurance, and is willing to pay premiums until retirement at age 65. What would be the right policy for his client? A) Increasing term insurance B) Limited pay whole life insurance C) 10-year endowment D) Life annuity, period certain - ✔✔B) Limited pay whole life insurance Under a 20-pay whole life policy, in order for the policy to pay the death benefit to a beneficiary, the premiums must be paid A) For 20 years. B) Until the policyowner's age 100, when the policy matures. C) For 20 years or until death, whichever occurs first. D) Until the policyowner's age 65. - ✔✔C) For 20 years or until death, whichever occurs first. At age 30, a man wants to start an insurance program, but realizing that his insurance needs will likely change, he wants a policy that can be modified to accommodate those changes as they occur. Which of the following policies would most likely fit his needs? A) Decreasing Term B) Adjustable Life C) Single Premium Whole Life D) Modified Life - ✔✔B) Adjustable Life In an Adjustable Life policy all of the following can be changed by the policy owner EXCEPT A) The type of investment B) The length of coverage. C) The premium D) The amount of insurance - ✔✔A) The type of investment An Adjustable Life policyowner can A) Change the investment account. B) Change the insured C) Change the coverage period. D) Change the mortality experience. - ✔✔C) Change the coverage period. Which of the following is an example of a limited-pay life policy? A) Straight Life B) Life Paid-up at Age 65 C) Renewable Term to Age 70 D) Level Term Life - ✔✔B) Life Paid-up at Age 65 An insured has a life policy that requires him to only pay premiums for a specified number of years until the policy is paid up. What kind of policy is it? A) Industrial Life B) Graded Premium Life C) Limited-pay Life D) Variable Life - ✔✔C) Limited-pay Life Adjustable life can be best described as which of the following? A) An annuity. B) A form of life insurance that allows changes on the policy face amount, premium mode and amount, and period of protection. C) Term coverage that cannot be converted into permanent insurance. D) A permanent life insurance policy that generates immediate cash value. - ✔✔B) A form of life insurance that allows changes on the policy face amount, premium mode and amount, and period of protection. Which of the following statements is correct regarding Adjust Life? A) Evidence of insurability may be required when insurance is increased. B) It is a form of variable annuity. C) It is most appropriate for people who purchase insurance at older ages. D) The type of coverage may be changed only if the new form of coverage has decreasing premiums - ✔✔A) Evidence of insurability may be required when insurance is increased. If an agent wishes to sell variable life policies, what license must the agent obtain? A) Personal Lines B) Securities C) Adjuster D) Surplus Lines - ✔✔B) Securities An insured has a variable life policy with a $100,000 face amount. At one time, the cash value exceeded $100,000 and was worth $150,000. During this time, the policy face amount was increased to $150,000. In the following year, the cash value took a significant decline and was worth only $70,000. What was the policy's face amount adjusted to? A) $70,000 B) $80,000 C) $100,000 D) $150,000 - ✔✔C) $100,000 Equity Indexed Whole Life is policy with what kind of index as its investment feature? A) Consumer Price B) Equity C) Consumer investment D) Universal - ✔✔B) Equity Donald purchased a Life Insurance policy from company A. The agent told Donald that depending upon the company's investments and expense factors, the cash values could be more or less that those shown in the policy at issue time. Donald's policy is a/an A) Annual Renewable Term. B) Adjustable Life. C) Interest-sensitive Whole Life. D) Credit Life. - ✔✔C) Interest-sensitive Whole Life [Show More]

Last updated: 3 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

ALL VA CHAPTERS Questions with accurate answers,100% verified, EASY WAY TO PASS.

ALL YOU NEED TO PASS THE CH VA QUESTIONS ALL VA CHAPTERS Questions with accurate answers,100% verified, EASY WAY TO PASS.

By Topmark 3 years ago

$32

14

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2022

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2022

Downloads

0

Views

156