Question 1

1.A.1.b

tb.fin.inc.010_1805

LOS: 1.A.1.b

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: hard

Bloom Code: 4

The most likely use of an income statement prepared by

...

Question 1

1.A.1.b

tb.fin.inc.010_1805

LOS: 1.A.1.b

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: hard

Bloom Code: 4

The most likely use of an income statement prepared by a business enterprise is its use by which of the following?

Labor unions to examine earnings closely as a basis for salary discussions.

Government agencies to formulate tax and economic policy.

Customers to determine a company's ability to provide needed goods and services.

Rationale

Investors interested in the financial performance of the entity.

The FASB's conceptual framework identifies potential investors and creditors as the primary focus of financial statements. An income statement

provides information about a business's profitability. Whether a business is profitable is likely to influence an investor's decision to invest in that

business as it is one aspect of its financial performance. Therefore, this is the correct answer.

Rationale

Labor unions to examine earnings closely as a basis for salary discussions.

While labor unions may examine earnings as a basis for salary discussions, it is just one factor in those discussions. In addition, the FASB conceptual

framework identifies potential investors and creditors, not labor unions, as the primary focus of financial statements. Therefore, this is an incorrect

answer.

Rationale

Government agencies to formulate tax and economic policy.

An income statement provides information about one business and is not likely to be very useful to formulate tax and economic policy. It is based

on accrual accounting, which is different from tax accounting. Therefore, this is an incorrect answer.

Rationale

Customers to determine a company's ability to provide needed goods and services.

A customer may use an income statement to assess a company's financial performance as a company in poor financial condition may not be

reliable supplier. However, it is not likely to be the major factor in the decision. Therefore, this is an incorrect answer.

Investors interested in the financial performance of the entity.

CorrectQuestion 2

1.A.1.a

tb.fin.inc.001_1805

LOS: 1.A.1.a

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: medium

Bloom Code: 4

Which aspect of a firm's statement of cash flows most interests potential stockholders?

Changes in the firm's inventory balance

The firm's gains and losses from selling plant assets

Rationale

The firm's investments in new plant assets

Potential shareholders are generally most interested in a firm's ability to increase its stock price and pay dividends. While investment in new plant

assets may give some information about a firm's growth potential, it does not provide the most useful information to potential shareholders

because it does not involve dividends. Therefore, this is an incorrect answer.

Rationale

Changes in the firm's inventory balance

A change in a firm's inventory balance is important information. However, potential shareholders are more interested in cash flow generated.

Additionally, the change in inventory is better seen by looking at the balance sheet. Therefore, this is an incorrect answer.

Rationale

The firm's gains and losses from selling plant assets

Gains and losses from selling plant assets is important information. However, potential shareholders are more interested in cash flow generated.

Therefore, this is an incorrect answer.

Rationale

The firm's ability to pay dividends

Potential shareholders are generally interested in a firm's ability to increase its stock price and pay dividends. The statement of cash flows provides

information about cash generated (that can be used for future dividends) and cash used to pay dividends in the past. Therefore, this is the correct

answer.

The firm's ability to pay dividends

Correct

The firm's investments in new plant assets

Your AnswerQuestion 3

1.A.1.e

tb.fin.inc.018_1805

LOS: 1.A.1.e

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: medium

Bloom Code: 4

When using the indirect method, which statement provides the most accurate description of the relationship between accounts receivable and the

operating activities section on the statement of cash flows?

A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows.

A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows.

Rationale

An increase in accounts receivable results in an increase in the operating activities section on the statement of cash flows.

An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of

the operating activities section) uses cash sales and not cash collections, adding the increase in accounts receivable would result in “double

counting” cash collections. Therefore, this is an incorrect answer.

Rationale

An increase in accounts receivable results in a decrease in the operating activities section on the statement of cash flows.

An increase in accounts receivable means that sales made on credit exceeded collections from customers. Since net income (the starting point of

the operating activities section) uses cash sales and not cash collections, the increase in accounts receivable must be subtracted when calculating

cash flow from operating activities. Therefore, this is the correct answer.

Rationale

A decrease in accounts receivable results in a decrease in the operating activities section on the statement of cash flows.

A decrease in accounts receivable means that collections from customers exceeded sales made on credit. Since net income (the starting point of

the operating activities section) uses cash sales and not cash collections, the decrease in accounts receivable must be added when calculating cash

flow from operating activities, not subtracted. Otherwise, cash flow from operating activities would be understated. Therefore, this is an incorrect

answer.

Rationale

A decrease in accounts receivable results in no change in the operating activities section on the statement of cash flows.

A decrease in accounts receivable means that collections from customers exceeded sales made on credit. Since net income (the starting point of

the operating activities section) uses cash sales and not cash collections, the decrease in accounts receivable must be added when calculating cash

flow from operating activities. Otherwise, cash flow from operating activities would be understated. Therefore, this is an incorrect answer.

An increase in accounts receivable results in a decrease in the operating activities section on the statement of cash flows.

Correct

An increase in accounts receivable results in an increase in the operating activities section on the statement of cash flows.

Your Answer

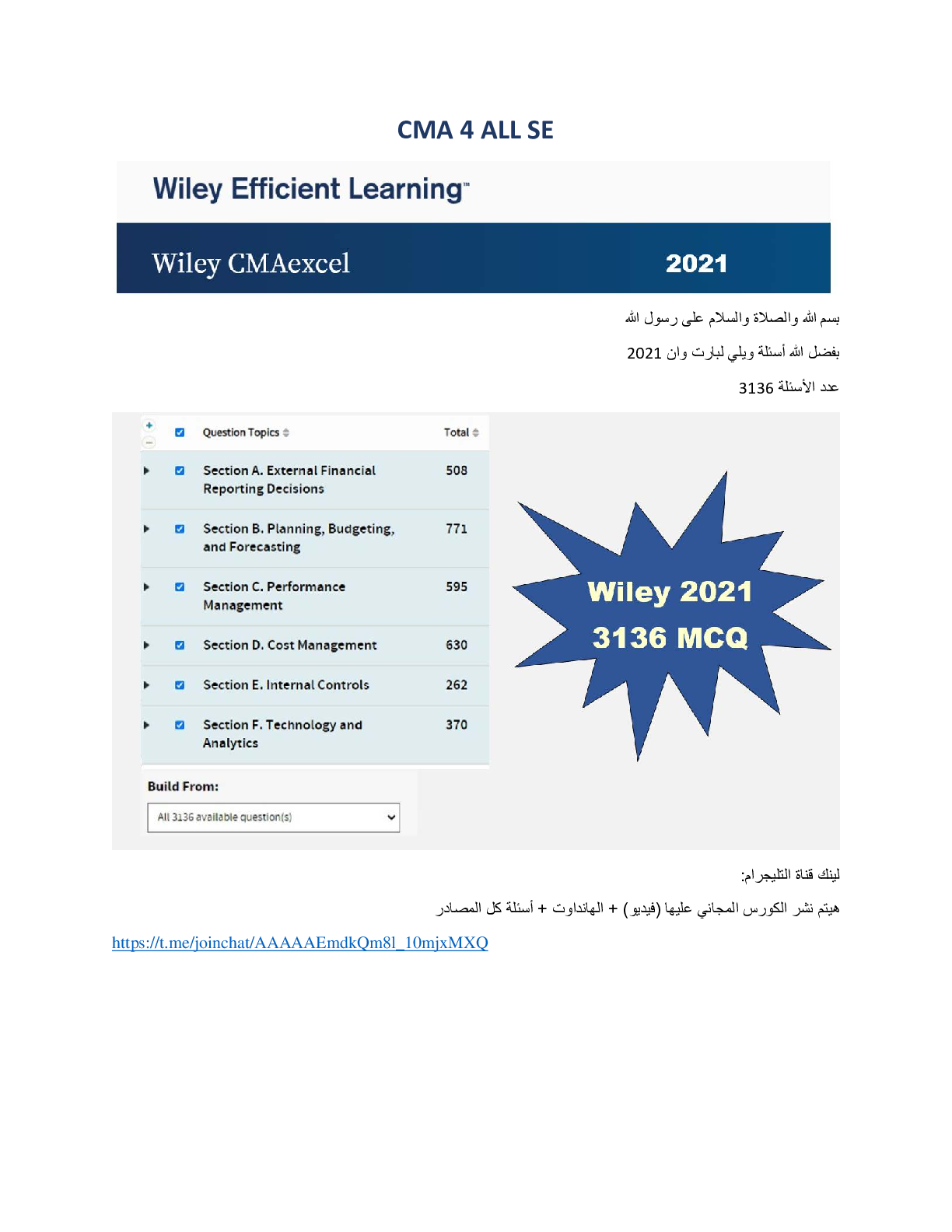

https://t.me/joinchat/AAAAAEmdkQm8l_10mjxMXQQuestion 4

1.A.2.dd

tb.fin.inc.042_1805

LOS: 1.A.2.dd

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: medium

Bloom Code: 4

According to the FASB's conceptual framework, which of the following is/are included in comprehensive income?

Neither gross margin nor operating income

Gross margin

Operating income

Rationale

Neither gross margin nor operating income

Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net

income is the starting point for calculating it. Since operating income and gross margin are both components of net income, they are also

components of comprehensive income. Therefore, this is an incorrect answer.

Rationale

Gross margin and operating income

Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net

income is the starting point for calculating it. Since operating income and gross margin are both components of net income, they are also

components of comprehensive income. Therefore, this is the correct answer.

Rationale

Gross margin

Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net

income is the starting point for calculating it. Since gross margin is a component of net income, it is also a component of comprehensive income.

However, operating income is also a component. Therefore, this is an incorrect answer.

Rationale

Operating income

Comprehensive income includes all changes in equity during a period except changes from investments by owners and distributions to owners. Net

income is the starting point for calculating it. Since operating income is a component of net income, it is also a component of comprehensive

income. However, gross margin is also a component. Therefore, this is an incorrect answer.

Gross margin and operating income

CorrectQuestion 5

1.A.2.dd

fin.inc.tb.048_0120

LOS: 1.A.2.dd

Lesson Reference: Overview of Financial Statements and the Income Statement

Difficulty: medium

Bloom Code: 3

A company is preparing its financial statements in accordance with U.S. GAAP. Listed below are select financial data for the company.

Net income = $950,000

Depreciation = $40,000

Investment by owners = $60,000

Unrealized gain on available-for-sale securities = $90,000

Foreign currency translation loss = $20,000

What is the amount that would be reported as comprehensive income?

*Source: Retired ICMA CMA Exam Questions.

$970,000

$1,060,000

$1,120,000

Rationale

$970,000

This answer is incorrect. Depreciation is not added back to net income when calculating comprehensive income since comprehensive income is not

based on cash flow. In addition, owner investment is not included in comprehensive income since comprehensive income does not focus on

transactions with owners. Finally, unrealized gains on available-for-sale securities and foreign currency translation losses should be included when

calculating comprehensive income.

Rationale

$1,020,000

The calculation of comprehensive income starts with net income and includes unrealized gains and losses on available-for-sale securities, cash flow

hedges gains and losses, foreign currency translation gains and losses, and gains and losses in pension and post-retirement benefit plans. In this

example, comprehensive income includes the net income of $950,000, the unrealized gain on available-for-sale securities of $90,000, and the

foreign currency translation loss of $20,000 ($950,000 + $90,000 − $20,000). This results in comprehensive income of $1,020,000.

Rationale

$1,060,000

This answer is incorrect. Depreciation is not added back to net income when calculating comprehensive income since comprehensive income is not

based on cash flow.

Rationale

$1,120,000

This answer is incorrect. Depreciation is not added back to net income when calculating comprehensive income since comprehensive income is not

based on cash flow. In addition, owner investment is not included in comprehensive income since comprehensive income does not focus on

transactions with owners.

[Show More]