Requirement

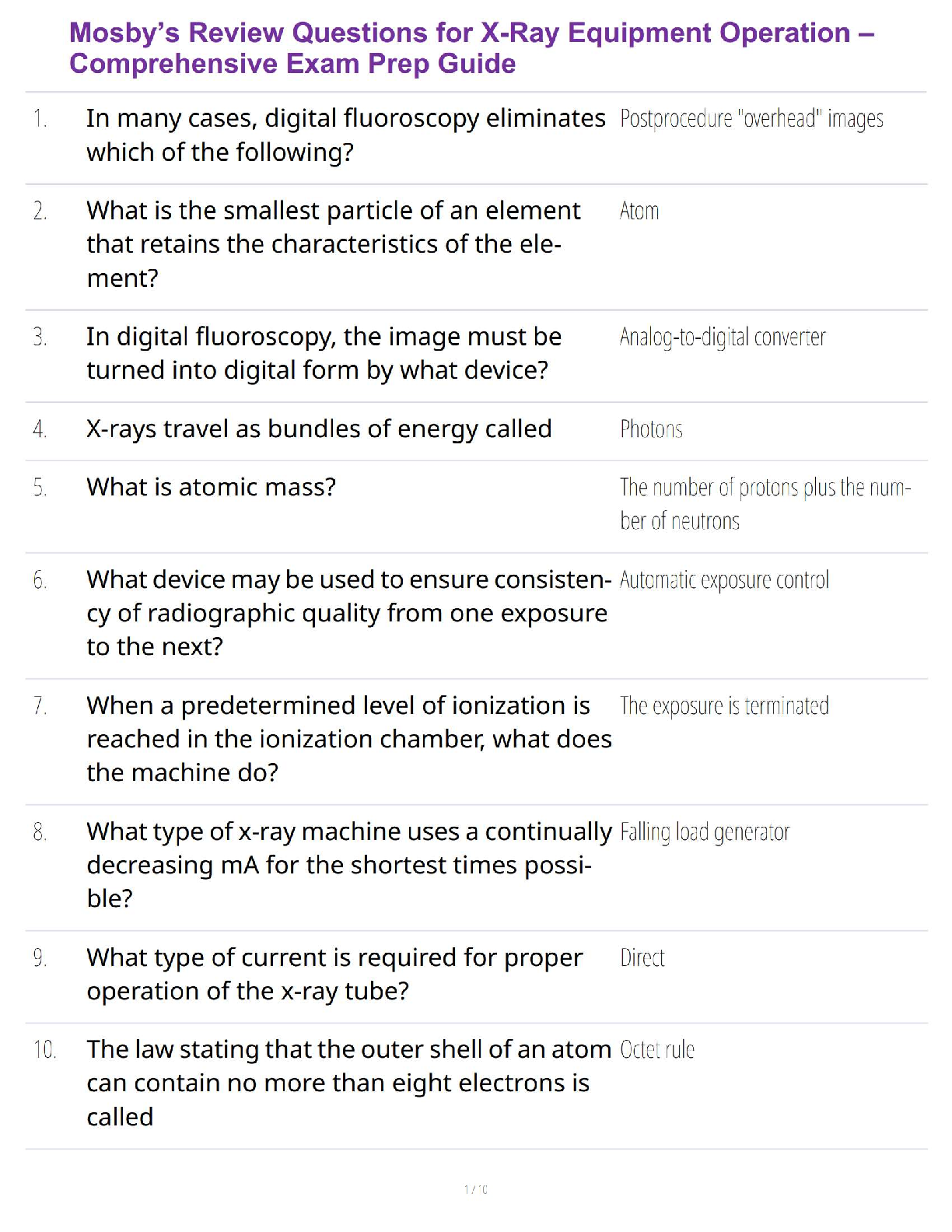

1. Report these items on Robarge Electronics' balance sheet at June 30, 2018.

First, select the balance sheet accounts. Refer to the information to determine which accounts will be classified as current lia

...

Requirement

1. Report these items on Robarge Electronics' balance sheet at June 30, 2018.

First, select the balance sheet accounts. Refer to the information to determine which accounts will be classified as current liabilities, and which will be classified as

long-term liabilities. Remember, current liabilities are due within one year of the balance sheet date.

Robarge Electronics

Balance Sheet (partial)

June 30, 2018

Account

Current liabilities:

Accrued warranty payable

Current portion of long-term note payable

Interest payable

Unearned sales revenue

Employee withheld income tax payable

FICA tax payable

Total current liabilities

Long-term liabilities:

Note payable

a. Sales of are subject to an accrued warranty cost of %. The accrued warranty payable at the beginning of the year was , and warranty payments

for the year totaled .

$2,000,000 8 $31,000

$56,000

Many companies provide warranties with their products. A warranty guarantees that a company will repair or replace a product or provide a refund for it if it is found to be

defective within a certain period of time. The expense recognition (matching) principle requires a company to record the warranty expense for a product in the same

period that the business records the product's sales revenue. After all, the warranty motivates customers to buy products, so the company must record the warranty

expenses related to the products when they are sold. At the time of the sale, however, the company doesn't know which products are defective. The exact amount of

warranty expense cannot be known with certainty, so the business must estimate warranty expense and the related accrued liability.

Now calculate the warranty expense. The business uses an estimate usually based on prior history. Electronics estimates that warranty costs, or expense, will

be % of sales revenue. (Enter the interest rate as a whole number.

[Show More]

.png)

.png)

.png)

.png)