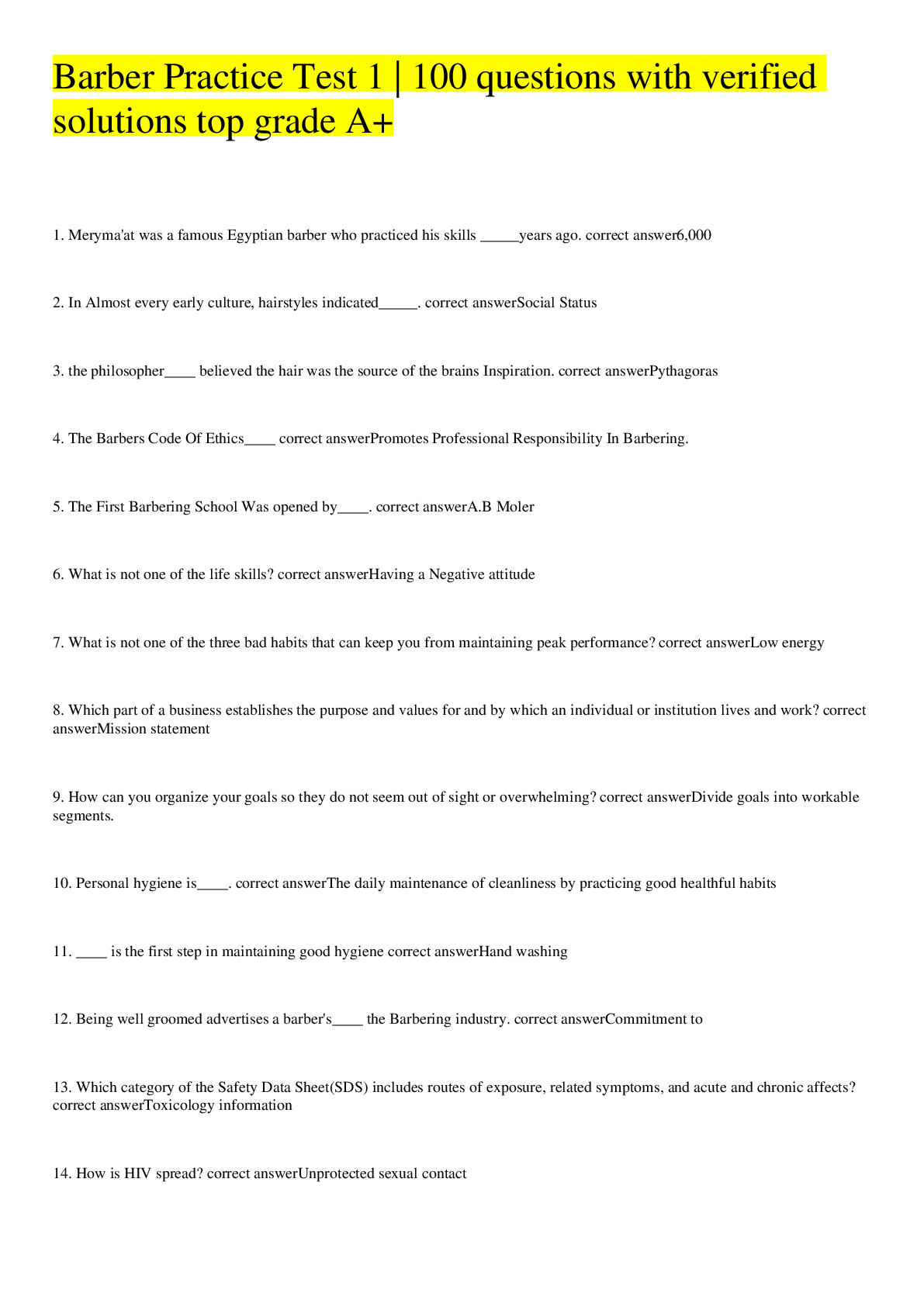

Barber Practice Test 1 | 100 questions with verified solutions top grade A+

$ 10.5

PEDS 602 Cardiac_Drip_Presentation_2020 | PEDS602 Cardiac_Drip_Presentation_PEDS 602 Cardiac_Drip_Presentation_2020 | PEDS602 Cardiac_Drip_Presentation_NEW VERSION VERSION

$ 13.5

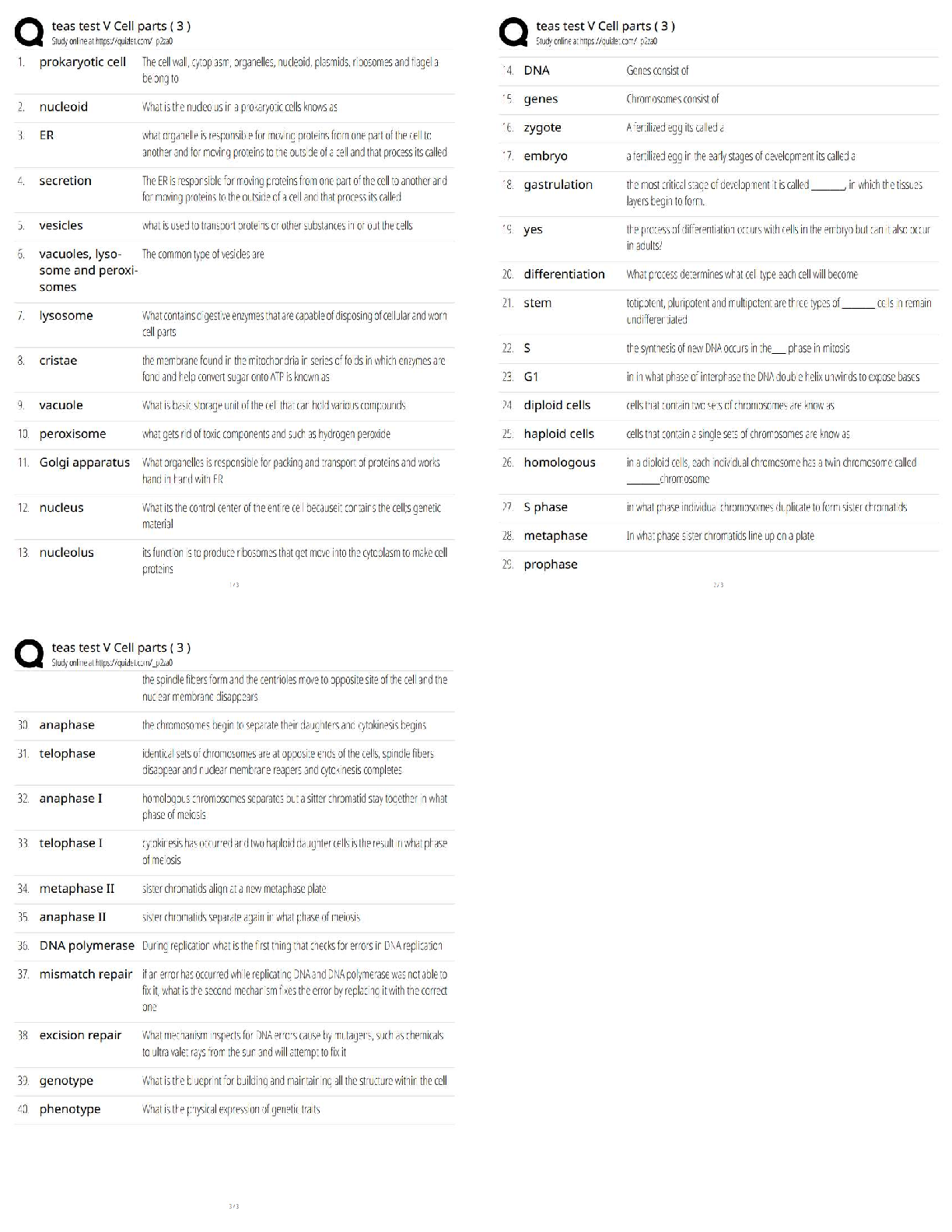

biology

$ 4.5

[eTextBook] [pdf] Applied Law and Ethics in Health Care 1st Edition By Wendy Mia Pardew

$ 29

Atomic Structure and Interatomic Bonding.

$ 16.5

Edexcel A Level In GCE URDU (9UR0/1) Paper 1:Translation +mark scheme May 2025

$ 9

.png)

Gen 499 Week 4 Quiz with All the Answers 25/25 correct(100% correct and grade A+)

$ 10

HESI COMPREHENSIVE EXIT EXAM 2025 STUDY QUESTIONS WITH ANSWERS GUARANTEED PASS | RATED A+

$ 17

STAT 200 Week 6, Verified Answers Well Explained, Already Graded A+

$ 8

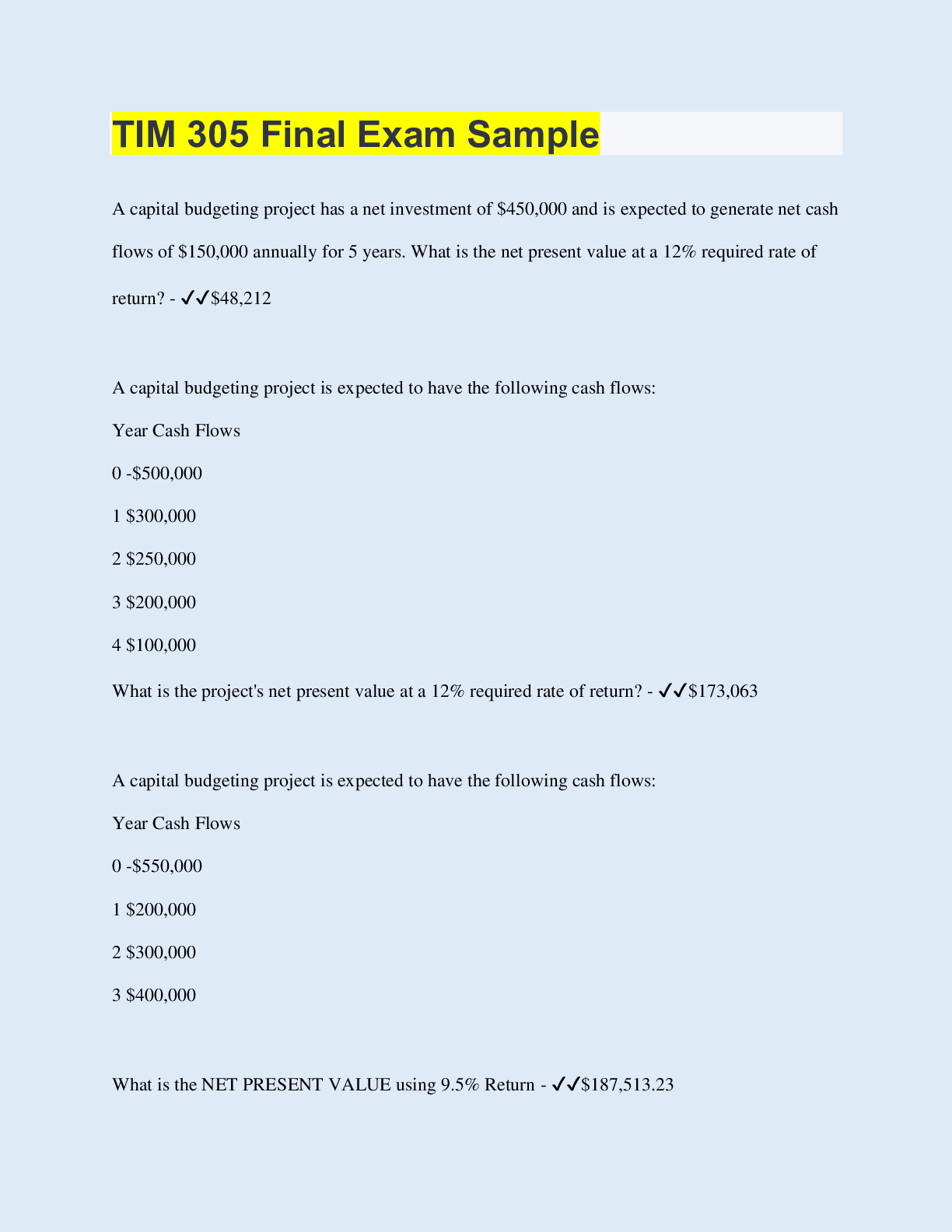

FINA 365 Final Exam Review

$ 15

NURSING 311: CARE OF OLDER ADULTS: CULTURE, SPIRITUALITY, COMMUNICATION,SEXUALITY, INFECTION CONTROL TEST BANK WITH VERIFIED ANSWERS 9TH EDITION/2023,VSU

$ 2

Leadership RN ATI Proctored Focus Exam

$ 10

NR 360 Unit 2 Assignment: Technology Presentation

$ 15.5

CPH CERTIFIED IN PUBLIC HEALTH EXAMS

$ 18

📘 NUR 101 > NCSBN Test Bank - NCLEX-RN & NCLEX-PN Examination ✅

$ 25

Introductory Maternity and Pediatric Nursing 4th Edition Hatfield Test Bank 2022

$ 10

NURSING 3431 GLOBAL OPTIONS NURSING CAPSTONE EXAM Q & A 2024

$ 11

Biological Psychology A-level Revision Notes AQA(A) By PsychLogic, updated 2020

$ 5

COMP 230 iLab Report Week 6 (VBScript IP File Lab Document)

$ 11

SAT 2021 Test 2 Passages 1-3. Reading Test 65 MINUTES | Download To Score An A

$ 10.5

ORC 1 organizational_behavior_chapter 1_quiz

$ 11

Instructor's Manual With Case Notes For Essentials of Organizational Behavior 15th Edition (Global Edition) By Stephen Robbins, Timothy Judge (All Chapters, 100% Original Verified, A+ Grade)

$ 25

INSTRUCTOR’S SOLUTIONS MANUAL STATISTICS FOR MANAGERS USING MICROSOFT® EXCEL® NINTH EDITION David Levine A+

$ 9.5

Liberty University GLST 200 Quiz 4 GRADE A ASSURED

$ 8.5

Reflection on Course 39C. Graded A. No plagiarism. 100%