INTRODUCTION

What is a liability? The answer might seem rather obvious: an amount owed from one entity to another. In fact, many

liability situations, especially those related to financial liabilities, are straightforw

...

INTRODUCTION

What is a liability? The answer might seem rather obvious: an amount owed from one entity to another. In fact, many

liability situations, especially those related to financial liabilities, are straightforward from an accounting perspective.

However, when liabilities are estimated or uncertain, they can present accounting challenges. For instance:

• Does a liability exist if there is no legal liability but the company has announced a particular commitment or plan of

action?

• How is a liability measured if the obligation is for services, not a set amount of money?

• How can a liability be measured if the amount of cash to be paid is based on future events?

Liability financing is an integral part of the capital structure of many companies. For example, Canadian Tire Corporation

Limited is a Canadian company that offers a range of general merchandise and also apparel, sporting goods, petroleum,

and financial services to consumers. The company reported total assets of $14.5 billion in 2014. Of this amount, $5.6

billion, or 33%, was financed through shareholders’ equity, with the balance, $8.9 billion, or 67%, provided by debt in

various forms. A sizable portion of the debt represents deposits from the financial services segment ($2.2 billion, or 15%

of total assets) and trade payables represent 14% of assets ($2 billion). There are also long-term loans of $2.1 billion, or

14% of total assets. The balance is allocated to non-controlling interest.

This chapter reviews common liabilities, including both financial liabilities and provisions. Financial statement classification

and disclosure are reviewed. Long-term debt is covered in Chapter 13. Chapter 14 deals with accounting for share equity.

Then, Chapter 15 addresses coverage returns to debt arrangements, those that have some attributes of debt and some

attributes of equity. Innovative financial markets have introduced significant complexities into the accounting world!

LIABILITY DEFINITION AND CATEGORIES

According to the conceptual framework, a liability is defined as a present obligation of the entity arising from past events,

the settlement of which is expected to result in an outflow of economic benefits. Settlement could be accomplished

through future transfer or use of assets, provision of services, or other yielding of economic benefits. These characteristics

can be simplified for practical purposes by remembering that a liability:

• Is an expected future sacrifice of assets or services;

• Constitutes a present obligation; and

• Is the result of a past transaction or event.

Note that there are three time elements in the definition: a future sacrifice, a present obligation, and a past event. All three

elements are necessary for a liability to be recognized. It is not possible to create a liability from an anticipated future

event, such as expected future operating losses. There must be some past transaction that is identifiable as an obligating

event, which is an event that creates an obligation where there is no other realistic alternative but to settle the obligation.

Constructive Obligations

Some liabilities are legal obligations, or liabilities that arise from contract or legislation. Most liabilities are legal obligations,

including trade payables and borrowings. Other liabilities are constructive obligations, where a liability exists because

there is a pattern of past practice or established policy. A company can create a constructive obligation if it makes a public

statement that the company will accept certain responsibilities because the statement creates a valid expectation that the

company will honour those responsibilities. Others rely on this representation. Thus, a liability can be created when a

company reacts to moral or ethical factors.

ETHICAL ISSUES

A company has announced a voluntary product recall that will take several months to complete. Customers have been

offered a replacement product or repair on the original unit. The recall was prompted by the company’s code of ethics to

support its product integrity and customer base. The recall is voluntary in that the defect is not covered by warranty, and

no legislation exists to force the company to act. In this case, clear communication to another party establishes the

obligation. A constructive liability exists and the anticipated costs of the recall must be accrued.

Categories of Liabilities

Accounting for liabilities depends on whether the liability fits into one of two categories:

• Financial liabilities; or

• Nonfinancial liabilities.

A financial liability is a financial instrument. A financial liability is a contract that gives rise to a financial liability of one party

and a financial asset of another party. That is, one party has an account payable and the other party has an account

receivable. Another example is a loan payable and a loan receivable. The two elements are mirror images of each other.

A nonfinancial liability can be defined by what it is not—any liability that is not a financial liability is a nonfinancial liability.

A non-financial liability has no offsetting financial asset on the books of another party. Provisions, or liabilities that have

uncertainty surrounding timing or amount, are a major category of non-financial liabilities.

Examples of nonfinancial liabilities include:

• Revenue received in the current period but not yet earned (i.e., unearned revenue); or

• Cash outflows that are expected to arise in the future but that are related to transactions,

decisions, or events of the current period (e.g., a decommissioning obligation).

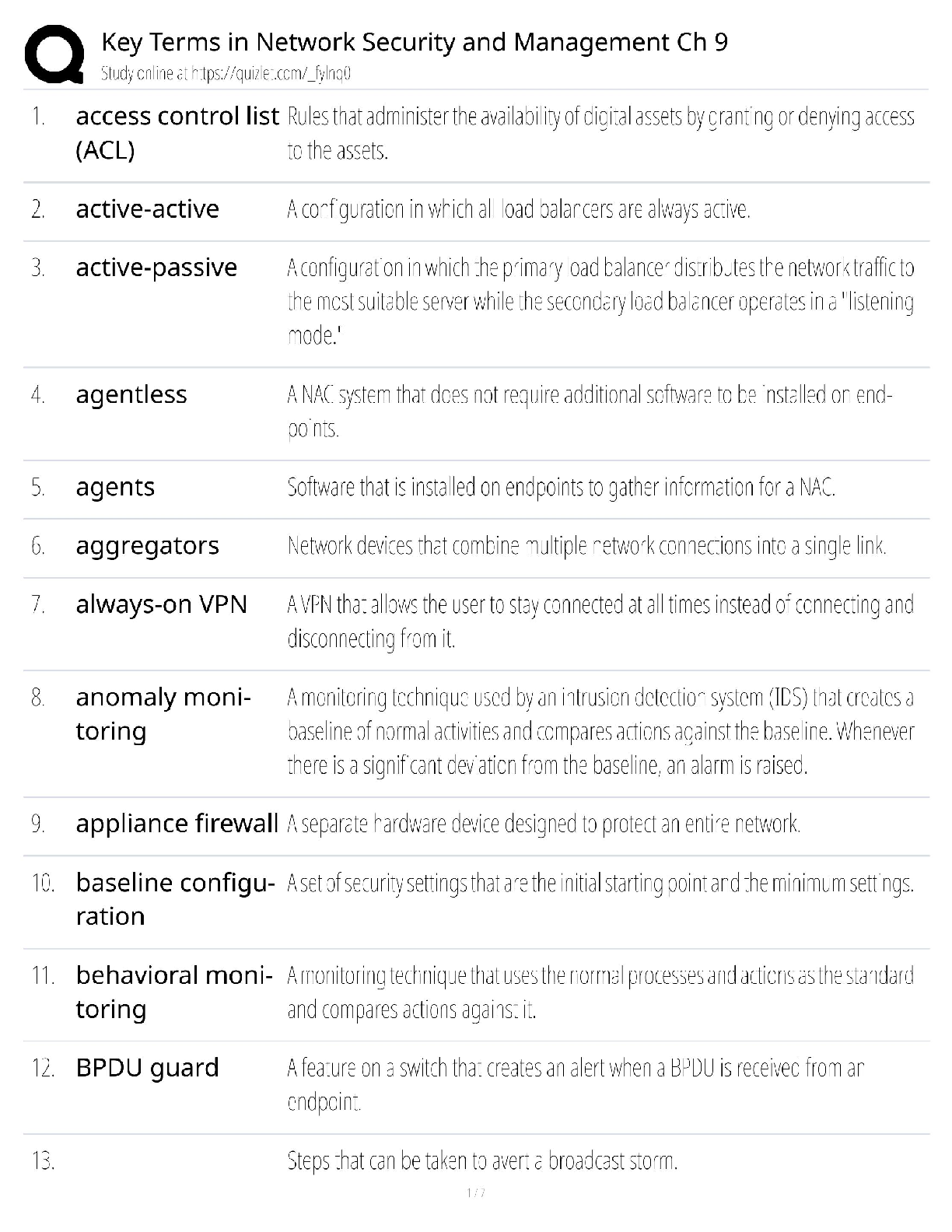

Categories of Financial Liabilities

Financial liabilities themselves fall into two categories. Classification determines the subsequent measurement of the

financial liability.

Most liabilities fall in the other financial liabilities category. The FVTPL liability category is meant primarily for liabilities that

will be sold or transferred in the short term. In other circumstances, management may designate liabilities as FVTPL. This

might be appropriate, for example, if various hedging strategies were in place and management wished to have both

hedged asset and liability in the same category for valuation purposes.

FVTPL for liabilities is similar to assets discussed in earlier chapters with the exception of subsequent measurement of

liabilities designated in FVTPL. For those liabilities the fair value change related to changes in credit risk are recognized in

OCI with the remainder of fair value changes recognized in earnings. The exception to this is if this would create or

increase an accounting mismatch, then all of the changes would go into earnings.

Specifically, the alternatives can be summarized as follows:

Classification

Summarized

Classification Criteria Initial Valuation Subsequent Valuation

1. “Other” financial

liabilities

Most financial liabilities;

all those except those in

category 2, below

Fair value, which is the

transaction value and

establishes the cost of the

financial instrument

Capitalize:

Transaction costs, if any

Cost

(Amortized cost)

2. Fair value through

profit or loss

(FVTPL)

May be FVTPL if:

a. The liability will

be sold in the

short term; or

b. Designated

FVTPL by

management to

avoid an

accounting

mismatch

(related/hedged

financial

instruments are

FVTPL)

Fair value, which is the

transaction value and

establishes the cost of the

financial instrument.

Expense transaction costs,

if any.

a. Fair value; gains

and losses in

earnings

b. Fair value; change

in fair value due

to changes in

credit risk in OCI

remainder in

earnings

Measurement of Other Financial Liabilities

Other financial liabilities are initially measured as the fair value of the consideration received and capitalized transaction

costs (which reduces the liability) and then carried at this value (which is cost), or amortized cost, over their lives. That is,

the initial fair value is (generally) the stated amount of the transaction, or the transaction price.1 For example, a company

receives an invoice for the fair value of goods shipped by a supplier; the goods are the consideration, and their invoice

price is the fair value of the liability.

Discounting

Liabilities of all categories must be valued at the present value of cash flows—commonly called discounting—where the

time value of money is material. The discount rate chosen must reflect the current market interest rate, specific to the risk

level of the liability. Note, however, that if the amount and timing of cash flows is highly uncertain, then discounting is not

possible and undiscounted amounts are recorded. When liabilities are discounted, interest expense on the discounted

liability is recorded as time passes. Discounting will be illustrated later in the chapter.

Reporting Example

Included in its significant accounting policy disclosure, Canadian Tire reports information about the valuation of financial

liabilities. These liabilities are valued at amortized cost. Provisions, which are non-financial liabilities, are measured based

on best estimate and are discounted, if the effect of discounting is material.

The Company’s … financial liabilities are generally classified and measured as follows:

Asset/Liability Category Measurement

Bank indebtedness Other liabilitiesAmortized cost

Deposits Other liabilitiesAmortized cost

[Show More]

.png)