Ch05 Audit Evidence and Documentation

Chapter Opener

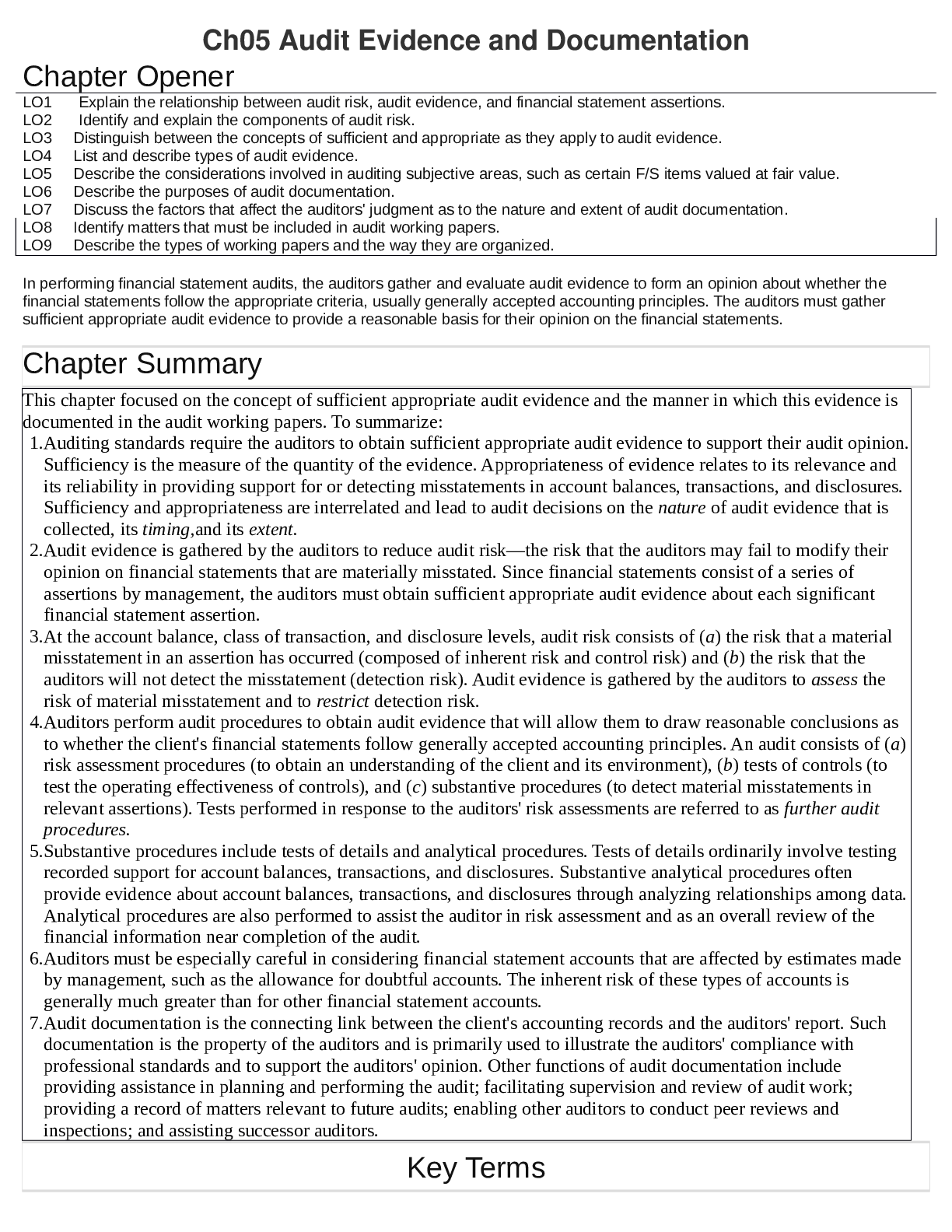

LO1 Explain the relationship between audit risk, audit evidence, and financial statement assertions.

LO2 Identify and explain the components of audit risk.

LO3 Dis

...

Ch05 Audit Evidence and Documentation

Chapter Opener

LO1 Explain the relationship between audit risk, audit evidence, and financial statement assertions.

LO2 Identify and explain the components of audit risk.

LO3 Distinguish between the concepts of sufficient and appropriate as they apply to audit evidence.

LO4 List and describe types of audit evidence.

LO5 Describe the considerations involved in auditing subjective areas, such as certain F/S items valued at fair value.

LO6 Describe the purposes of audit documentation.

LO7 Discuss the factors that affect the auditors' judgment as to the nature and extent of audit documentation.

LO8 Identify matters that must be included in audit working papers.

LO9 Describe the types of working papers and the way they are organized.

In performing financial statement audits, the auditors gather and evaluate audit evidence to form an opinion about whether the

financial statements follow the appropriate criteria, usually generally accepted accounting principles. The auditors must gather

sufficient appropriate audit evidence to provide a reasonable basis for their opinion on the financial statements.

Chapter Summary

This chapter focused on the concept of sufficient appropriate audit evidence and the manner in which this evidence is

documented in the audit working papers. To summarize:

1. Auditing standards require the auditors to obtain sufficient appropriate audit evidence to support their audit opinion.

Sufficiency is the measure of the quantity of the evidence. Appropriateness of evidence relates to its relevance and

its reliability in providing support for or detecting misstatements in account balances, transactions, and disclosures.

Sufficiency and appropriateness are interrelated and lead to audit decisions on the nature of audit evidence that is

collected, it is timing and its extent.

2. Audit evidence is gathered by the auditors to reduce audit risk—the risk that the auditors may fail to modify their

opinion on financial statements that are materially misstated. Since financial statements consist of a series of

assertions by management, the auditors must obtain sufficient appropriate audit evidence about each significant

financial statement assertion.

3. At the account balance, class of transaction, and disclosure levels, audit risk consists of (a) the risk that a material

misstatement in an assertion has occurred (composed of inherent risk and control risk) and (b) the risk that the

auditors will not detect the misstatement (detection risk). Audit evidence is gathered by the auditors to assess the

risk of material misstatement and to restrict detection risk.

4. Auditors perform audit procedures to obtain audit evidence that will allow them to draw reasonable conclusions as

to whether the client's financial statements follow generally accepted accounting principles. An audit consists of (a)

risk assessment procedures (to obtain an understanding of the client and its environment), (b) tests of controls (to

test the operating effectiveness of controls), and (c) substantive procedures (to detect material misstatements in

relevant assertions). Tests performed in response to the auditors' risk assessments are referred to as further audit

procedures.

5. Substantive procedures include tests of details and analytical procedures. Tests of details ordinarily involve testing

recorded support for account balances, transactions, and disclosures. Substantive analytical procedures often

provide evidence about account balances, transactions, and disclosures through analyzing relationships among data.

Analytical procedures are also performed to assist the auditor in risk assessment and as an overall review of the

financial information near completion of the audit.

6. Auditors must be especially careful in considering financial statement accounts that are affected by estimates made

by management, such as the allowance for doubtful accounts. The inherent risk of these types of accounts is

generally much greater than for other financial statement accounts.

7. Audit documentation is the connecting link between the client's accounting records and the auditors' report. Such

documentation is the property of the auditors and is primarily used to illustrate the auditors' compliance with

professional standards and to support the auditors' opinion. Other functions of audit documentation include

providing assistance in planning and performing the audit; facilitating supervision and review of audit work;

providing a record of matters relevant to future audits; enabling other auditors to conduct peer reviews and

inspections, and assisting successor auditors.

Key TermsAdjusting journal entries (AJEs) Journal entries are designed to correct misstatements found in a client's records. (162)

Administrative working papers Working papers are specifically designed to help the auditors in the planning and

administration of the engagement, such as audit programs, internal control questionnaires and flowcharts, time budgets,

and engagement memoranda. (161)

Appropriate A measure of the quality of the evidence obtained. (141)

Audit evidence Any information that corroborates or refutes the auditors' premise that the financial statements present fairly

the client's financial position and operating results. (141)

Audit file The unit of storage for a specific audit engagement. The audit documentation for each year's audit of a company is

included in its audit file. (160)

Audit risk The risk that the auditors may unknowingly fail to appropriately modify their opinion on financial statements that

are materially misstated. (137)

Common-size financial statements Financial statements that present each amount as a percentage of some financial

statement base. As an example, a common-size income statement presents all revenues and expenses as a percentage of net

sales. See vertical analysis. (152)

Control risk The risk that a material misstatement that could occur in an account will not be prevented or detected on a timely

basis by internal control. (140)

Corroborating documents Documents and memoranda included in the working papers that substantiate representations

contained in the client's financial statements. These working papers include audit confirmations, lawyers' letters, copies of

contracts, copies of minutes of directors' and stockholders' meetings, and representation letters from the client's

management. (163)

Cross-sectional analysis A technique that involves comparing the client's ratios for the current year with those of similar

firms in the same industry. (152)

Cutoff The process of determining that transactions occurring near the balance sheet date are assigned to the proper accounting

period. (162)

Date of the auditor's report The date on which the auditor has obtained sufficient appropriate audit evidence to support the

opinion on the financial statements or other financial information being reported upon. The audit report is ordinarily dated

as of this date. (148)

Detection risk The risk that the auditors' procedures will lead them to conclude that a financial statement assertion is not

materially misstated when in fact such misstatement does exist. (140)

Documentation completion date The date on which documentation should be completed. This is within 60 days of the

delivery date. (161)

Electronic data interchange (EDI) A system in which data are exchanged electronically between the computers of different

companies. In an EDI system, source documents are replaced with electronic transactions created in a standard

format. (144)

Estimation transaction A transaction involving management's judgments or assumptions, such as determining the allowance

for doubtful accounts, establishing warranty reserves, and assessing assets for impairment. (140)

Experienced auditor For purposes of audit documentation, an individual who has practical audit experience and a reasonable

understanding of audit processes; (2) Statements on Auditing Standards and applicable legal and regulatory requirements;

(3) the business environment in which the entity operates; and (4) auditing and financial reporting issues relevant to the

entity's industry. Having practical audit experience is equivalent to possessing the competencies and skills that would have

enabled the experienced auditor to perform the audit. (159)

Further audit procedures The additional procedures that are performed based on the results of the auditors' risk assessment

procedures. Such procedures include additional tests of controls (if needed) and substantive tests of account balances,

classes of transactions, and disclosures. (149)

Horizontal analysis A technique that involves comparing financial statement amounts and ratios for a particular company

from year to year. (152)

Inherent risk The risk of material misstatement of a financial statement assertion, assuming there were no related

controls. (139)

Lead schedule A working paper with columnar headings similar to those in a working trial balance, set up to combine similar

ledger accounts, the total of which appears in the working trial balance as a single amount. (162)

p. 170

Material Of substantial importance. Significant enough to affect evaluations or decisions by users of financial statements.

Information that should be disclosed so that financial statements constitute a fair presentation. Involves both qualitative and

quantitative considerations. (162)

Minutes A formal record of the issues discussed and actions taken in meetings of stockholders or the board of directors. (159)Nonroutine transaction A transaction that occurs only periodically, such as counting and pricing inventory, calculating

depreciation expense, or determining prepaid expenses. (139)

Permanent file A file of working papers containing relatively unchanging data, such as copies of articles of incorporation and

bylaws; copies of minutes of directors', stockholders', and committee meetings; and analyses of such ledger accounts as

land and retained earnings. (164)

Physical evidence Evidence derived by the auditors from physical examination. (146)

Reclassification journal entry (RJE) A working paper entry drafted by the auditors to assure fair presentation of the

client's financial statements, such as an entry to transfer accounts receivable credit balances to the current liabilities section

of the client's balance sheet. Since reclassification entries do not correct misstatements in the client company's accounting

records, they are not posted to the client's ledger accounts. (162)

Related party transaction A transaction in which one party has the ability to influence significantly the management or

operating policies of the other party, to the extent that one of the transacting parties might be prevented from pursuing fully

its own separate interests. (158)

[Show More]

.png)

.png)

Solved.png)

.png)