Birbicator/ Birb_Stochastic_TK

1. Introduction

Welcome to the Birbicator. This indicator provides a new way to view price momentum

which combines the trusted insight of Stochastic momentum combined with a proprietary

...

Birbicator/ Birb_Stochastic_TK

1. Introduction

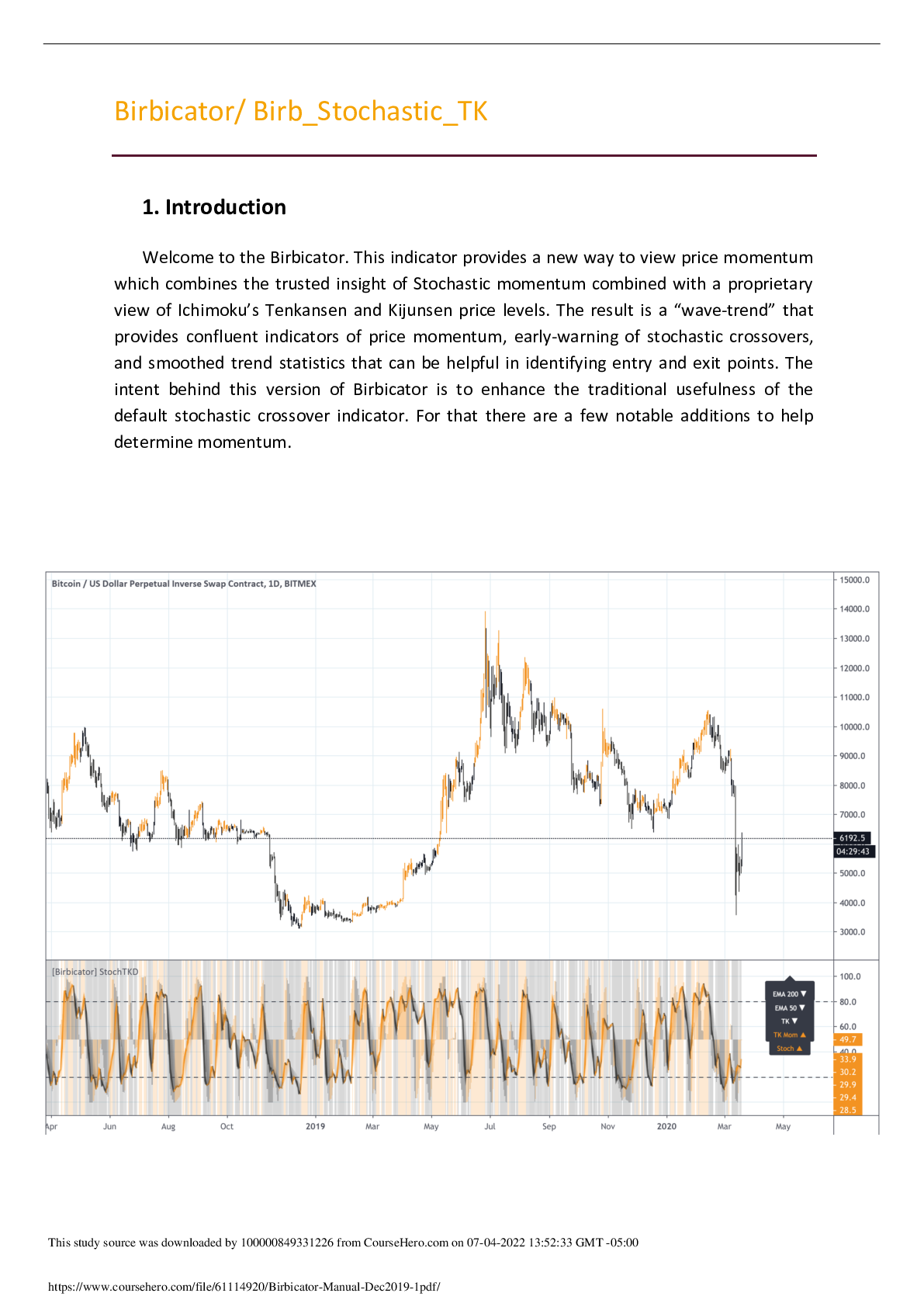

Welcome to the Birbicator. This indicator provides a new way to view price momentum

which combines the trusted insight of Stochastic momentum combined with a proprietary

view of Ichimoku’s Tenkansen and Kijunsen price levels. The result is a “wave trend” that

provides confluent indicators of price momentum, early warning of stochastic crossovers,

and smoothed trend statistics that can be helpful in identifying entry and exit points. The

intent behind this version of Birbicator is to enhance the traditional usefulness of the

default stochastic crossover indicator. For that, there are a few notable additions to help

determine momentum.

Components & Rules

• Standard Stochastic - This provides a baseline for price change momentum, and

gives the leading indicator for trend strength. Stochastics oscillate between 0 and

100, where bullish is above 80 and bearish is below 20.

• Stochastic “Guppy” - You will find “shading” following the primary Orange/Grey

stochastic ribbon, which is actually a multi-length ribbon of the default stochastic

ribbon meant to provide better clarity during times when standard stochastic is

ranging or finding its impulsive move over or under the standard signal line. The

“shading” can give verification/confirmation of the stochastic crossover being more

powerful and thus having a higher degree of certainty of trend confirmation. Put

simply, the “shading” is a moving average to the primary orange/grey stochastic line,

and can be used as such to determine more powerful crossover events (e.g., a 5/8

MA crossover is less “significant” than a 5/21 MA crossover — this same principle

applies to the “shading” of the primary stochastic orange/gray line)

[Show More]

.png)