CORPORATE LAW EXAM STUDY GUIDE – MLL221

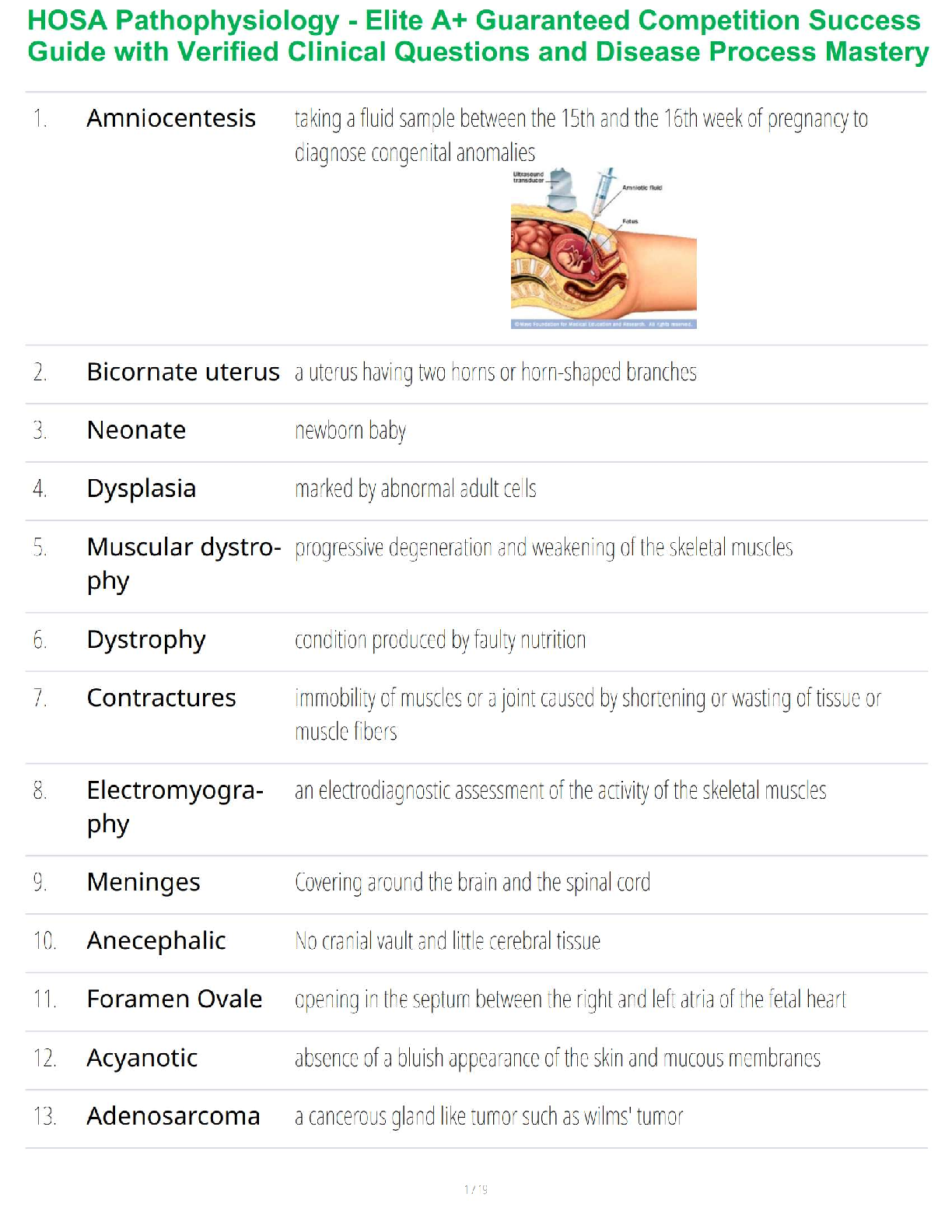

NOTE!!! TOPICS 1-7 ARE NOT EXAMINABLE!

Power to legislate given to the Commonwealth Parliament under s51(xx) of

Australian Constitution (power not given to states)

Topic 1/2

...

CORPORATE LAW EXAM STUDY GUIDE – MLL221

NOTE!!! TOPICS 1-7 ARE NOT EXAMINABLE!

Power to legislate given to the Commonwealth Parliament under s51(xx) of

Australian Constitution (power not given to states)

Topic 1/2 – Regulatory Framework + Registration

Quest for Cth Control

Corporations Act 1989 (Cth)

Cth legislated independently of the States to introduce a national scheme

NSW v Cth (1990)

• Does s.51(xx) of the Constitution grant the Commonwealth the power to

make laws in relation to the ‘incorporation’ of companies?

• s.51(xx) empowers the Cth Parl to:

– “make laws ... with respect to ... Foreign corporations, and trading or

financial corporations formed within the limits of the Commonwealth”

• Majority of the High Court (6:1)

– The word ‘formed’ is used in the past tense to refer to companies that

have already been incorporated.

– This means the Commonwealth can not rely on s.51(xx) to make laws

about bringing new companies into existence (i.e. the process of

incorporating companies)

– “The power conferred by s.51(xx) to make laws with respect to

artificial legal persons is not a power to bring into existence the

artificial legal persons upon which laws made under the power can

operate.” (para 8)

1991 Cooperative scheme – Corporations Law

• Cth amended the unconstitutional Corporations Act 1989 – called the

‘Corporations Law’

• Each State enacted legislation which adopted the Corporations Law to be its

Corporations Law

• Cth authorised the ASC (now ASIC) to exercise powers conferred by state

legislation

• Cross-vesting of jurisdiction in corporations law matters in the Fed Ct and

state Supreme Courts

Re Wakim (1999)

• HC held the cross vesting of jurisdiction was unconstitutional to the extent it

conferred jurisdiction on the Federal Court with respect to matters under

state law (i.e. the Corporations Law of each state)

R v Hughes (2000)

• HC cast doubt on the constitutionality of a scheme because it involved the

states (under their respective Corporations Laws) conferring powers on

Commonwealth officers

Corporations Act 2001 (Cth)

• State referral of power to the Commonwealth under s.51(xxxvii) Constitution

• Act commenced operation on 15 July 2001

Regulators

Australian Securities & Investments Commission

• Commonwealth Agency (b/c referral of State power)

• Responsible for ensuring the Corporations Act is complied with

• Legislative authority:

– ASIC Act 2001 (Cth)

– Corporations Act 2001 (Cth)

• Powers include:

– Investigate breaches of the Corps Act

– Instigate civil proceedings and criminal prosecutions (concurrent

with DPP)

– Advises ministers on necessary changes to the Corps Act

– Educational role

• More than 2 million Australian companies

• 99% of these are companies limited by shares

Australian Stock Exchange

• Private Company

• Public companies that ‘list’ on the stock exchange ‘contract’ with the ASX

that they will comply with the Listing Rules

Takeovers Panel

• A peer review body with at least 5 members

• Important part of the machinery for the control of company takeovers

(formerly, these powers were held by the Courts)

• Has power to declare ‘unacceptable circumstances’

Company

Sources of Law & Regulation

Statute: Corporations Act 2001 (Cth)

Common law

Constitution (& Replaceable Rules)

ASIC, ASX & Takeovers Panel

Separate legal

entity status

• On registration, a company becomes a separate legal person

• (s.119) A company comes into existence as a body corporate at the beginning

of the day on which it is registered

• (s.124) Legal capacity of:

– Natural person

• Own property

• Contract

• Sue and be sued

– Body corporate

• Issue shares

• Grant a charge

Concepts

Separate legal status

Limited liability

Corporate veil

Perpetual succession

Consequences of treating the company as a separate legal entity

1. Company’s obligations and liabilities are its own, and not those of its

participants

• Shareholders have limited liability

• Liability of shareholders is limited to the amount they have not paid

on their shares.

• So if a shareholder has fully paid for the shares – he has no liability

• If only paid $1 on a share that was issued by a company at the price of

$3 – the shareholder’s liability would be limited to the amount unpaid

on the share - $2

2. Company can sue and be sued in its own name

3. Company has perpetual succession

4. Company’s property is not the property of its participants

5. Company can contract with its participants

Salomon v Salomon & Co Ltd (1897)

Facts

• Mr S was the sole trader of a shoe and leather business

• Co Act 1862 (UK) required 7 shareholders

• Salomon & Co Ltd incorporated

• Mr S 99% shareholder and managing director

• Mr S sold business to Co for cash and secured debt

Board of Directors

Company

Shareholder

A

Shareholder

B

Shareholder

C

• Business failed, assets of Co insufficient to repay secured (Mr S) and

unsecured creditors

Arguments

Liquidator argued that because the business operated by the Company was

the same as that operated by Mr S, and because Mr S had effective control of

the Company, the court should hold Mr S liable for the loss suffered by the

Company

Held

• A company is a separate legal entity even though a single person manages

and controls it

• A company can contract with its controlling participants

“The company is at law a different person altogether from the

subscribers to the memorandum [shareholders]; and, though it may

be that after incorporation the business is precisely the same as it was

before, and the same persons are managers, and the same hands

receive the profits, the company is not in law the agent of the

subscribers or trustee for them. Nor are the subscribers as members

liable, in any shape or form, except to the extent and in the manner

provided in the Act.” (Lord Macnaghten at 51)

Note! – In rejecting agency argument:

“Either the limited company was a legal entity or it was not. If it was, the

business belonged to it and not to Mr Salomon. If it was not, there was no

person and no thing to be an agent at all; and it is impossible to say at the

same time that there is a company and there is not.” (31)

Lee v Lee’s Air Farming Ltd [1961]

Facts

• Company operated a crop dusting business

• Mr Lee was the main shareholder and managing director of the company

• Mr Lee was also an employee pilot

• While working, Mr Lee was killed in a plane crash

• Mrs Lee claimed she was entitled to workers compensation because Mr Lee

was an employee

• Insurer argued Mr Lee could not be an employee and employer

Privy Council

• A company is a separate entity from its controller – who may also be its sole

employee

• A company is a separate legal entity and a person may concurrently have a

variety of legal relationships with that company

Macaura v Northern Assurance Co Ltd [1925]

Facts

• Macaura assigned right to timber to a Company, received shares in

consideration

• Timber destroyed in fire

• Macaura claimed insurance – policy was in his individual name, not in name

of the Company

House of Lords

• Shareholders do not have a proprietary interest in a company’s property

• Insurance legislation required policy holder to have an ‘insurable interest’ in

the property

• The company was the owner of the timber, not Macaura (meaning he did not

have an ‘insurable interest’ and so could not claim on the insurance for the

damaged timber)

Note! – Company’s property is not the property of its participants.

CEPU v Queensland Rail [2015]

69. …referring to a corporation as "an entity with status as an artificial

person", Murphy J in Adamson's Case went on to state that "[t]he

constitutional description of trading corporations includes those bodies

incorporated for the purpose of trading; and also those corporations which

trade"[102] Those two ways in which his Honour identified the

constitutional description of trading corporation as capable of applying to a

corporation – by reference to its trading purpose or alternatively by

reference to its trading activity – must each be qualified to exclude that

which is insubstantial. This is not a case which calls for any examination of

that qualification or for any consideration of how purpose and activity might

interact in a case where the substantiality of a trading purpose or of a trading

activity might be marginal.

70. The basic point that the constitutional description of trading is

capable of being applied to a corporation either by reference to its

substantial trading purpose (irrespective of activity) or by reference to its

substantial trading activity (irrespective of purpose) is sound in principle

and is supported by authority.

Note! - Thus, according to Qld Rail case a corporation refers to any entity with status

as an artificial person incorporated for purpose of trading.

Piercing the corporate veil

Corporate veil

• Legal rules that grant the company ‘separate legal personality’ and separate

the company from its participants (e.g. shareholders, directors) are referred

to as the veil of incorporation or corporate veil

• Salomon’s case established that a company and its participants must be

treated separately – i.e. the corporate veil protects the company’s

participants from liability

• This is the general rule in Australia

Note! - Only in exceptional circumstances will a court pierce the corporate veil and

disregard the separate legal personality of a company.

Common law exceptions

• Where company used to avoid existing legal duty

• Where company used for perpetuating a fraud

Statutory exceptions

• Insolvent trading

• Debts incurred as trustee

Where company is used to avoid existing legal duty

• Corporate veil may be pierced where company formed for sole or dominant

purpose of avoiding an existing legal duty

– OK to form a company to limit personal liability for future obligations,

but not to avoid existing obligation

• Gilford Motor Co Ltd v Horne

– Company formed for sole or dominant purpose of avoiding a noncompete clause

• Jones v Lipman

– Company formed for the sole or dominant purpose of avoiding a

contract for the sale and purchase of land

Insolvent trading

• Insolvency = company cannot pay its debts as they fall due for payment

• Corporations Act lifts the corporate veil when a company trades while

insolvent and imposes personal liability on directors for the company’s debts

(s.588G)

s.588G:

• Directors become personally liable if the fail to prevent the company incurring

a debt when there are reasonable grounds to suspect the company is

insolvent or the debt will render the company insolvent

• Defences – s.588H

Lifting the corporate veil of group companies

Adams v Cape Industries Pty Ltd - “…the court is not free to disregard the principle of

Salomon v Salomon merely because it considers that justice so requires. Our law, for

better or worse, recognises the creation of subsidiary companies, which though in

one sense the creatures of their parent companies, will nevertheless under the

general law fall to be treated as separate legal entitled with all the rights and

liabilities that would normally attach to separate legal entities:

Corporate liability for crimes and torts

Company liability

• A company is a legal fiction

• So how does the law impute an ‘action’ or ‘state of mind’ to a company to

hold the company liable for criminal or civil wrongs?

• Vicarious liability

• Direct liability

Vicarious liability

• Legislation may provide that company may be convicted for the actions of its

agents without the need to impute a guilty intent to the company

• Under common law, an employer (i.e. Company) is vicariously liable for the

acts of its employees in the course of employment

• Actor is personally liable and company is vicariously liable

Direct liability: Organic theory

• Company may be primarily liable when the act/intent of a person are taken

under the ‘organic theory’ to be the act/intent of the company itself

• Company liable for the act/intent of employees “who represent the directing

mind and will of the company, and control what it does.” HL Bolton

(Engineering) v TJ Graham and Sons Ltd [1956]

• Whether person constitutes the mind and will of the company determined on

case-by-case basis

• Seniority is key factor

Legislation

that lifts the

corporate veil

of group

companies

Holding

company’s

liability for

insolvent trading

by subsidiary

Consolidated

financial

statements

Taxation

consolidation

The benefit of

the group as a

whole

Pooling in

liquidation

• “Some of the people in the company are mere servants and agents who are

nothing more than the hands to do the work and cannot be said to represent

the mind or will. Others are directors and managers who represent the

directing mind and will of the company, and control what it does. The state of

mind of these managers is the state of mind of the company and is treated by

law as such.” per Lord Denning in HL Bolton (Engineering) v TJ Graham and

Sons Ltd [1956]

Tesco Supermarkets Ltd v Nattrass [1972]

Facts

• Radiant washing powder advertised at sale price

• Sale items all sold, shop assistant restocked items, but at full price

• Shop manager not aware of this

• Offence under legislation to sell products at higher price than as advertised

• Defense available if due to act or omission of another person

• Tesco argued that the shop manager and shop assistant were ‘another

person’

House of Lords

• Court applied the ‘organic theory’ to the shop manager and shop assistant

and held that neither represented the directing mind and will of the company

• Accordingly, the acts of the shop manger and shop assistant were not the acts

of the company

Types of

business

structures

Company

‘separate

legal

entity’

Sole trader

Partnership Joint

Venture

Trust

Types of business structures

Trust - used a lot as a business structure - often a company is seen as a

trustee - for asset protection - seen as being extremely shady (trusts have big tax

implications - used to split income) - still not a separate legal entity

Company (‘separate legal entity’) - ongoing regulatory requirements - costs

money - official - must be in line with the Corporations Act (only form that has the

benefit of limited liability)

Sole Trader

Joint Venture - typically seen when its a joint venture between two

companies (relationship regulated by contract [can be two individuals - generally

companies] its not a separate legal entity just a relationship)

Partnership - partnerships are a little more complex because people can leave

- no separate legal entity - also question of liability (risk associated is that everything

is joint)

Company

Pro

• Separate legal entity

• Limited liability

• Perpetual succession

• Flexibility

– Share classes

– Liquidity

• Finance

Con

• Corporations Act compliance

• Establishment and ongoing costs

• Shareholders less involved in management

• Public disclosure requirements

Sole proprietor/Trader

Individual conducts his/her own business

Pro

• Simple

• Minimal establishment costs

• Minimal regulatory compliance issues

• High level of control

Con

• No limited liability

• Small size makes raising finance difficult

• Limited lifespan

Partnership

Carrying on a business in common with a view to profit (s.5 Partnership Act)

Pro

– Minimal establishment costs: only need meet definition of partnership

– Minimal regulatory compliance issues

– Active in the conduct of the business

Con

– No separate legal entity: partners contract personally for the partnership

– Risk: partners incur debts/obligations on behalf of other partners i.e. joint

and several liability

– Size limited to 20 partners (subject to exceptions)

Joint Venture

Contractual relationship similar to partnership but relationship is not a business in

common

Pro

– Severally liability: i.e. obligations and liabilities can be individualised

(unlike partnership)

– Inexpensive to create and maintain

Con

– No limited liability

– No perpetual succession

Trust

A relationship – not a legal entity (many types)

Pro

– Beneficiaries have an equitable interest in trust property; contra

shareholders who have no legal/equitable interest in company property

– Income splitting – but may be contrary to anti-tax avoidance

Con

– Maximum life span of 80 years (law against perpetuities)

– Beneficiaries have limited powers (unlike shareholders)

– No separate legal entity; trust cannot hold property, contract, sue or be

sued

– Trustee personally liable (may have right of indemnity from trust assets

and beneficiaries)

The process of registration (incorporation)

How to create a company

• Lodge application form 201 with ASIC & pay fee

• s.117 CA sets out the prescribed contents of the application:

– Whether company proprietary or public

– Members, number of shares and share classes

– Directors

• Pty – one ordinarily residing in Australia;

• Public – min of 3, 2 ordinarily residing in Australia

– Secretary

• Public – must have

– Consents of members, directors and secretary

– Address of registered office

– Constitution or replaceable rules

– Company name

• ASIC registers company, allocates ACN, issues certificate of registration

• Company comes into existence when registered (s.119)

Separate legal entity – so what?

• Company’s obligations and liabilities are its own, and not those of its

participants

• Company can sue and be sued in its own name

• Company has perpetual succession

• Company’s property is not the property of its participants

• Company can contract with its participants

• A person may concurrently have a variety of legal relationships with a

company (e.g. director, shareholder and employee)

Note! - Review on Salomon v Salomon

• Also ordinary for law firms to have a shelf company on the side which

changes its directors etc

• If a company exists for longer than a period of time – ASIC has to power to

deregister it (~18mths)

• Can you change the attributes of a company? – yes you can, once its set up

with founding members – doesn’t suggest that that’s what its always going to

look like

• Can also change the name of a company – all you have to do is pass special

resolution off members – ACN stays the same generally – entity stays the

same

Topics 3/4 – Types of companies & Constitution and replaceable rules

Company types

What makes a

company the

perfect

investment

vehicle

Pool resources

Access to capital

Shareholder capital

(shares)

Debt finance

Mitigate Risk

Limited Liability

Corporate Veil

Perpetual

Succession

Company lives after

shareholders die

Can transfer wealth Separation of

management &

ownership

Shareholder rights are

protected

Still have a voice

Make money

Dividends

Can sell shares

Tax benefits

Company

classification

Members

Liability

Limited by

shares

Limited by

guarantee

Unlimited

company

No liability

Public

Status

Public Company

Proprietary

Company

Small

Large

Company limited by shares

• Most popular

• Member’s liability to the company limited to amount unpaid on their shares

(s.516)

– So if shares are fully paid, there is no liability risk

• Warning to creditors:

– Limited or Ltd must be in company’s name (s.148(2))

• Can by public or proprietary

Company limited by guarantee

• Member’s liability limited to amount member undertaken to contribute if

company wound up (s.517)

• No share capital

• Often used for non profit activities

• Can only be a public company

Unlimited company

• A company whose members have no limit placed on their liability (s.9)

– i.e. Members are jointly and severally liable for company’s debts

without limitation upon winding up

• Not suitable for trading ventures, primarily used by professional associations

where members required to have unlimited liability

• Can be public or proprietary

No liability company

• Must be a mining company (s.112(2))

• Mining Company = constitution must state that its sole objects are mining

purposes (s.112(2)(b))

– If constitution permits activities that are not necessary for, or

incidental to, its mining purposes, the company will not meet the

definition of mining company: ASC v SIB Resources NL

• Can only be a public company

• Warning to creditors: ‘No Liability’ or ‘NL’ must be used in company’s name

(s.148(4))

Public & Proprietary companies

Public

• Company other than a proprietary company (s.9)

• All ASX listed companies are public

• Can invite public to subscribe for shares

• No restriction on maximum size of membership

Proprietary

• Must have no more than 50 non-employee shareholders (s.113(1))

• Must not engage in any activity that would require the lodging of a disclosure

document (s.113(3)) (limited exceptions)

• Must have ‘Proprietary Limited’ or ‘Pty Ltd’ at end of name (s.148(2))

Proprietary companies

Small proprietary company s45A(2)

• Less disclosure obligations

– Don’t have to prepare P&L account or balance sheet

– Subject to s.292(2)

• Don’t require an auditor

Large proprietary company s45A(3)

• More extensive disclosure and reporting obligations

• s.292(c):

– “A financial report and a directors’ report must be prepared for each

financial year by … all large proprietary companies”

• Do require an auditor

– Average cost of preparing an audited annual report is about $60,000

Converting a company’s status (Public to proprietary to public etc)

• Requires a special resolution

• Application through ASIC (s162/163)

• If quorum is at meeting the resolution can be made

Note! – Can always revert back to get rid of regulatory burdens

Holding and subsidiary companies

• A company may hold shares in another company

• All companies viewed as separate legal entities (and related body corporates)

• Company relationships:

– Subsidiary

– Holding company

– Related body corporate

Holding – subsidiary relationship – related body corporate

Why list?

Listing requirements

Minimum shareholder requirements

Company size

Additional Corps Act requirements

Remuneration report (s.300A)

Half-year and annual financial reports

Listing Rules

Continuous disclosure

Information that reasonable person expects would have

effect on price or value of shares

Corporate governance

Greater shareholder protection

ASX Listed Companies

S 46 - A company is a subsidiary of a (holding) company if:

– Holding Co controls composition of Subsidiary Co’s board;

– Holding Co could cast or control more than 50% of votes at Subsidiary

Co meeting;

– Holding Co holds more than 50% of issued shares in Subsidiary Co; or

– Subsidiary Co is a subsidiary of another subsidiary of Holding Co

S 50 - Companies in a holding – subsidiary relationship are ‘related bodies corporate

Note! – Just needs to be one of the components in s46. They must also be the

related bodies corporate s50.

Controlled entities

• Corporations Act also uses the concept of ‘control’ to define corporate groups

more broadly than the ‘related body corporate’ test

• S.50AA:

– A controls B if A has capacity to determine the outcome of decisions

about B’s financial or operating policies

– Consider the practical influence A has over B and patterns of

behaviour

(4) Constitution & Replaceable rules

What is in a company’s internal governance rules?

• Matters governed by internal governance rules typically include:

– Appointment, removal and powers of company’s officers

– Procedure for convening & conducting:

• Director’s meetings

• Member’s meetings

– Special rights attached to share classes

– Rules regarding dividends

What is in a

company’s internal

governance rules?

Identifying the

internal governance

rules

Replaceable rules Constitution

Adoption and

alteration of a

constitution

Limits on the right to

alter a constitution

Non compliance

with internal

governance rules

The constitution and

RR as a statutory

contract

Limits on the

enforcement of the

statutory contract

Single director &

shareholder

companies

– Rules regarding the transfer and transmission of shares

Identifying the internal governance rules

• (s.134) Rules that govern the internal regulation of a company consist of:

– Replaceable Rules set out in Corporations Act;

• Set of model rules a company may adopt

– Constitution; or

– Combination of Replaceable Rules and constitution

Before 1 July 1998

Memorandum of association

• Historically, the document by which the original incorporators signalled their

intent to form a company

• Included:

– Company name

– Share capital details

– Liability of members limited

– Initial subscriber details

– Objects clauses (older companies only)

Articles of association

• By-laws regarding internal governance

• Model articles referred to as Table A articles of association were included as

part of the (then) Corporations Law

• Companies could choose to:

– Adopt Table A

– Adopt different articles; or

– Combination

After 1 July 1998

• Requirement to have Memorandum & Articles of Association abolished to

simplify and modernise company law

• Set of model internal governance rules called ‘Replaceable Rules’ included in

Corporations Act

• Companies can use Replaceable Rules – or replace with something more

suitable

When do replaceable rules apply?

Note, RR do not apply to

single director / single

Replaceable rules

What do replaceable rules contain?

• RR are spread throughout the Corporations Act

• Section 141 sets out a table of provisions that are RR

When are replaceable rules appropriate to use?

• Depends on individual circumstances of the company and participants

• Most suitable for unlisted public company with two or more members

• Principle of majority rule

• Not suitable:

– Two equal shareholders

– Shareholders with particular rights

– Don’t include call and forfeiture provisions so not suitable if issuing

partly paid shares

Constitution

Adoption

• Rather than rely on RR as internal governance rules, company may adopt

different rules in the form of a ‘constitution’

• RR can be displaced or modified by company’s constitution: s.135(2)

Why adopt a constitution?

• Substitute different rules for some/all RR that are unsuitable (e.g. where

majority rule is not appropriate)

• Supplement RR (e.g. to permit different classes of shares or partly paid

shares)

• Collate all internal governance rules into one place

• Ensure any legislative amendment to RR doesn’t take effect unless specifically

adopted by the company

Companies formed before 1

July 1998

Can invoke RR by repealing existing

Mem & Arts (s.135)

Otherwise, Mem & Arts continue to

apply

Companies formed after 1

July 1998

RR apply automatically, unless

displaced or modified in accordance

with s.135(2)

• To satisfy ASX listing rules

Adoption & alteration of the constitution

Adoption

• Constitution may be adopted:

– On registration with written consent of every proposed member

s.136(1)

– After registration by special resolution: s.136(2)

• Special Resolution = resolution passed by at least 75% of votes

cast by members entitled to vote on the resolution (s.9)

Alteration

• A company may amend or repeal its constitution by special resolution of

members: s.136(2)

[Show More]